The VC market is still strong in China, despite indications to the contrary. The old saying goes, here, that 99% of the returns come from 5% of the firms. This means big bucks for the winners – and some interesting investment opportunities for VCs in Asia and the US.

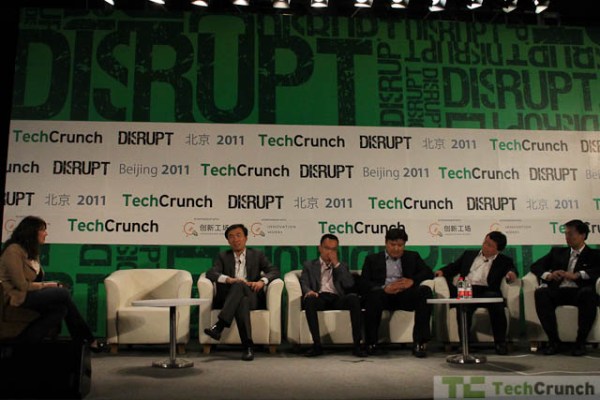

Sarah Lacy sat down with Steve Ji of Sequoia Capital, Rocky Lee of Cadwalader, Hugo Shong of Accel – IDG, and Hans Tung of Qiming Ventures.

“I feel bad for VCs in New York and California,” said Hans Tung. He explained that it was almost impossible to perform due diligence on a Chinese company by comparing it to an already existing company. The panel also agreed that most Chinese companies – when successful – are hard to displace.

“It’s a winner takes all environment,” said Rocky Lee. Chinese companies also are facing a different market. “They’re looking at content because of censorship, they’re looking at permits,” said Lee.

Sarah also discussed the notion that VCs in China will only handle copycats. The response? Yes… and no. The investors agreed that a few years ago that many sites were true copycats funded by folks who wanted China to have copies of Western sites. Now, however, VCs are interested in mobile Internet companies and ideas that are unique to the Chinese market.