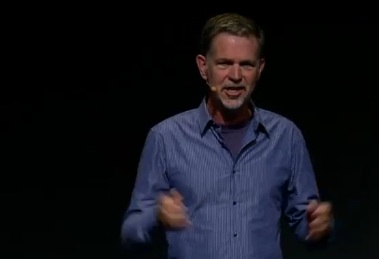

Netflix announced disappointing earnings today, and its expectations to go slide into unprofitability next year. The stock is trading at around $87 in after-hours, down from a close of $120. Following the blowback from his price change, CEO Reed Hastings says, “The focus for us is in rebuilding our reputation.”

Asked a question about the attempt to separate the DVD business from the streaming business and create a new in a new Qwikster brand (a plan now abandoned), Hastings admits now: “In hindsight, it is hard to justify. Having separate brands can in theory make sense. However after the price increase, Qwikster became the symbol of Netflix not listening.”

Below are my notes. You can listen to the entire Q&A in the audio embed below.

Earnings conference call Q&A:

Q: Why will subscriber additions be positive in November?

Reed: We have seen the second wave of cancellations. The first wave was in July, second wave was in September and October as people become more aware of price changes, those cancellation shave been declining.

Q: Why do you think December net adds will be strongly positive?

Reed: our marketing has been very successful for the past several years, don’t plan on changing it. very effective at attracting streaming subscribers.

Q: Why not reintroduce a combined streaming-DVD?

Reed: we think future is brightest for streaming. We don’t want to subsidize DVD. We think $7.99 is such a great price that mostly we should focus on filling out content.

The focus for us is in rebuilding our reputation

David Wells (CFO): We will be up slightly in subscribers in Q4. From a hybrid subscriber basis, we expect streaming only to be up substantially, DVD only up somewhat and hybrid to be down.

We anticipate growth of streaming subscribers to outpace growth of content costs.

Q: Why did you try to do Qwikster?

Reed: In hindsight, it is hard to justify. Having separate brands can in theory make sense. However after the price increase, Qwikster became the symbol of Netflix not listening.

DVD business will become like AOL dial-up. a slow decline.

We do expect to continue to expand exclusive licensing relationships

Q: Are you okay being rerun television?

Reed: It is not how we would describe us, but not entirely inaccurate.

David Wells: $3.5 billion streaming commitments, up from $2.4 billion.

Q: What is the split between movie streaming and TV streaming?

Reed: TV as a percentage of hours is ahead of movies, but round numbers each about half.

Q: What is your competitive advantage competing against the traditional pay channels? What about new entrants like Hulu and Amazon, Dish, Google, and Apple?

Reed: relative to pay television, it is not a zero sum game. Many people, including me, subscribe to HBO. There are multiple channels, people will consume from multiple providers. That said, when budgets are tight there is a hierarchy of which one you use most? We definitely want to use those.

We are on-demand, highly personalized, unique for each individual. and enormously great value, and unbundled from traditional cable business. In terms of new competitors, that is exactly what happens when you have an enormous new opportunity. Everybody sees that Internet video will be an enormous market over the next couple years. That is why we are focussed on streaming.

Q: What impact have you seen from Dish’s Blockbuster service or Amazon Prime

Reed: From neither one have we seen any impact.

Q: What advantage to you get from keeping the DVD business?

Reed: It is a source of profits funding international expansion and a source of satisfaction to the 10 million subscribers who still have it.