Since we first heard of BankSimple when Twitter’s Alex Payne left to join the venture, there has been a steady stream of funding news but not much in the way of real product. They’ve remedied that today with a walkthrough video of their web-based banking client. And I have to say, their promised of banking that “doesn’t suck” is looking intact.

This is strictly a broad-strokes video, showing the look and feel of the main screens and some of the more immediately-useful features. Considering the state of most online and mobile banking solutions, I don’t think they’re in too much of a hurry, but rather are content to explain at their own rate why their service will be better. Today is just the intro.

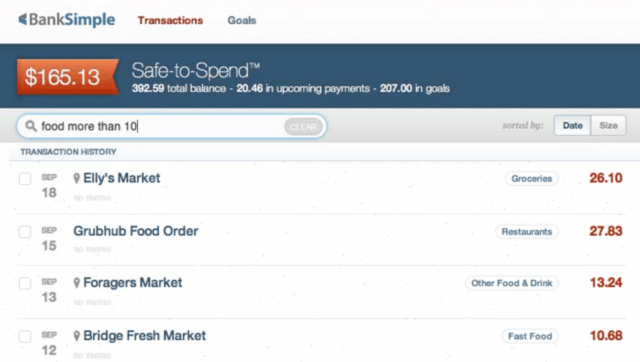

I don’t want to summarize the short and informative video, but a few points deserve commentary. The “safe to spend” balance is a great idea, but I’m afraid it might get complicated fast with linked accounts, credit lines, and the other details that tend to complicate banking. If all we ever did was deposit into and debit our accounts, banking might not even need the facelift BankSimple is aiming to provide.

That said, it’s a nice at-a-glance figure that both lets you know it’s okay to take the car in today and also reminds you of the goals for which you’ve sequestered money.

The searching really does look excellent. Understanding of search terms has evolved so far that it’s really inexcusable to have only simple string-matching queries for something as important as banking or medical records. It’s also helpful in the case of fraud. Having just recently had to clear up some fraudulent charges to my account, I would have loved to have quick access to my transactions with rich, plain-language search tools.

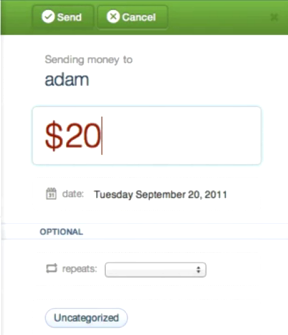

Hopefully sending money is as easy as it looks. As a commenter notes, it doesn’t debit immediately, which I would really expect from it. Since BankSimple already takes the liberty of presenting a “balance” that is strictly speaking a subjective interpretation of the data, it seems like that money should have disappeared from the safe-to-spend balance right away. That could very easily be implemented, but there might also be good reason for it. (Update: on rewatching the video, I find it’s clear that the moneygram is being “scheduled.” Still, it seems it should subtract from the safe-to-spend amount)

Hopefully sending money is as easy as it looks. As a commenter notes, it doesn’t debit immediately, which I would really expect from it. Since BankSimple already takes the liberty of presenting a “balance” that is strictly speaking a subjective interpretation of the data, it seems like that money should have disappeared from the safe-to-spend balance right away. That could very easily be implemented, but there might also be good reason for it. (Update: on rewatching the video, I find it’s clear that the moneygram is being “scheduled.” Still, it seems it should subtract from the safe-to-spend amount)

How versatile the money-sending and white cards are is also in question, though from their demos it appears they should work more or less identically to your “normal” bank card. But will we still have to deal with weirdo interstate banking laws, with international transaction fees, bank hour differences, holds on our accounts, things like that? Is this improving banking, or just the face of banking?

The interface is extremely promising, but when it comes to banking we need even more promises. Improving the searching and planning of month-to-month finances is a good thing, but what about all the other things about big banks that bother us so much? I like where they’re going with this (and the investment money says others do as well), but we should all maintain a healthy but hopeful skepticism until we see the whole story.