Mobile ad optimization platform Smaato, Inc. released the results of its latest mobile advertising report today, for Q2 2011. The findings include a look at mobile ad adoption, fill rates and the overall effect on mobile ad network performance.

Smaato’s Mobile Metric Report, based on over 80 million ad requests and over 60 connected ad networks across 230 countries, found that ad inventory was increasing at a faster rate than budgets, leading to a decline in advertising fill rates.

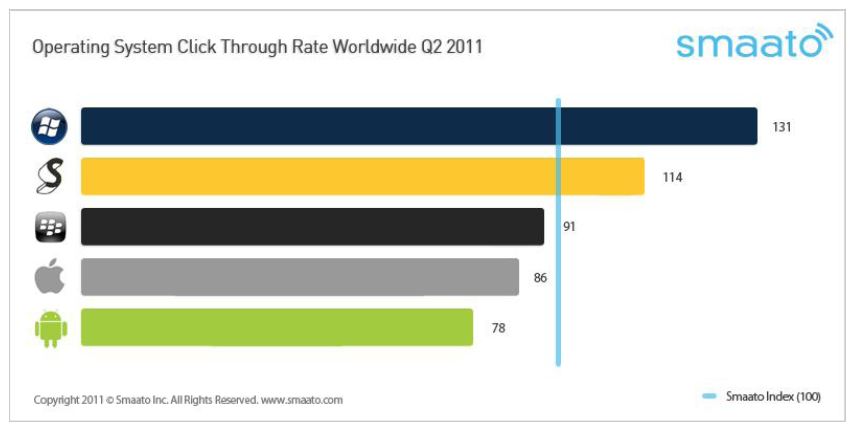

It also found that Windows Phone led iOS, Android, BlackBerry and Symbian in click-through rates both in the U.S. and worldwide.

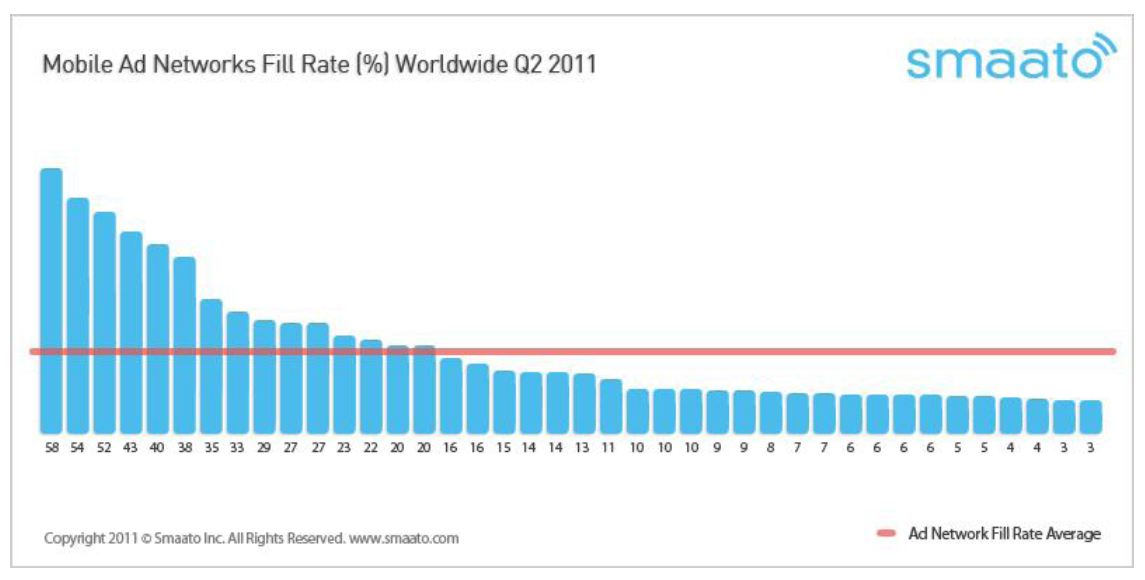

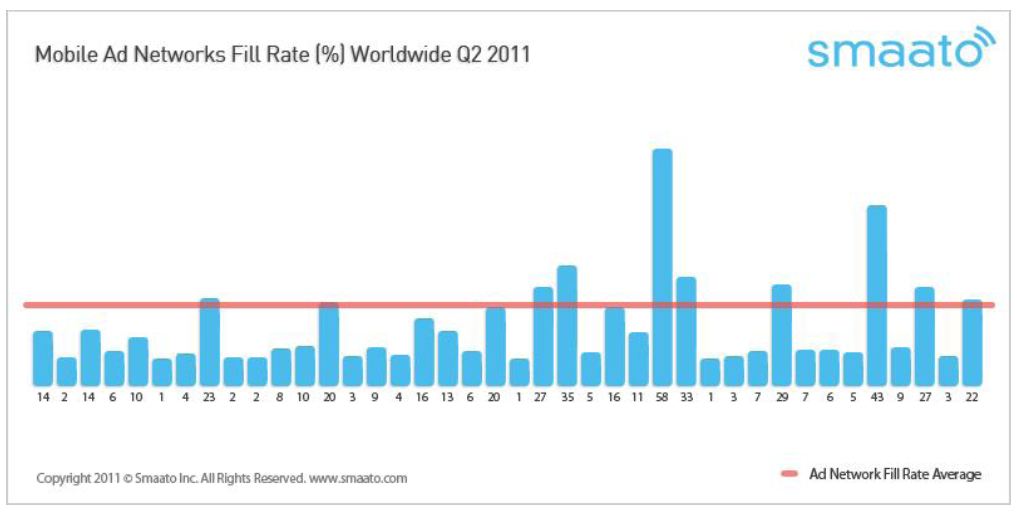

According to Smaato, the worldwide average ad network fill rate was 18% in Q2, a 2% drop from last quarter and a 3% decline year-over-year. Among the 40 top ad networks in the world, fill rates varied widely, running anywhere from 3% to 58%.

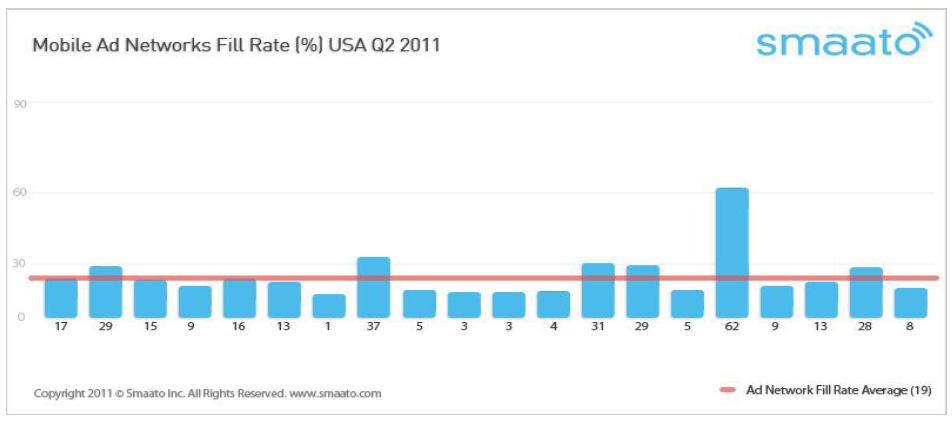

In the U.S., among the 20 top ad networks, fill rates declined 27% to 19%. Only 6 of the 20 performed above average (between 28-62%.) Says Smaato CMO Harald Neidhardt, current economic conditions are a factor in the fill rate decline, but it’s also an indication of an increasingly fragmented market.

Despite these drops, Smaato found that networks engaged in specialization saw greater returns, offering features like geo-location or video to add more value. Nine mobile ad networks out of the top 40 performed above the average Smaato Index, with rates ranging from 23% to 58%, despite “considerably” smaller volumes.

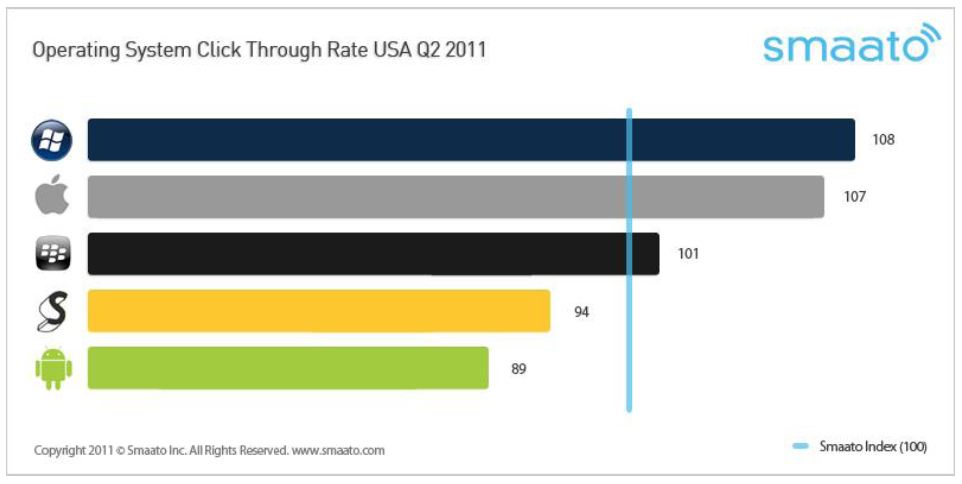

In its platform comparison, Smaato measured the average CTR (click-through rate) of all devices and set this number to 100.

Windows Phone (131) led the smartphone operating system (OS) index for the 2nd consecutive quarter, while RIM (91) overtook Apple (86) in ad performance on the Worldwide Performance Index. Nokia’s Symbian (114) is down from last year, and Android (76) increased performance by nearly 50%.

In the U.S., the smartphone platforms performed differently, however, with Windows Phone (108) just barely ahead of Apple’s iOS (107), but losing ground to Android (89). RIM moved into 3rd place, and Nokia’s Symbian trailed.

Neidhardt says the ad outlook for Android will continue to improve as low-cost Android-based smartphones enter the market alongside new Android-powered tablets in Asia. “As this trend continues, we will see even greater demand from big brands and advertisers for the Android platform,” he says, “and therefore greater revenue opportunities for publishers and developers as Android continues to proliferate.”

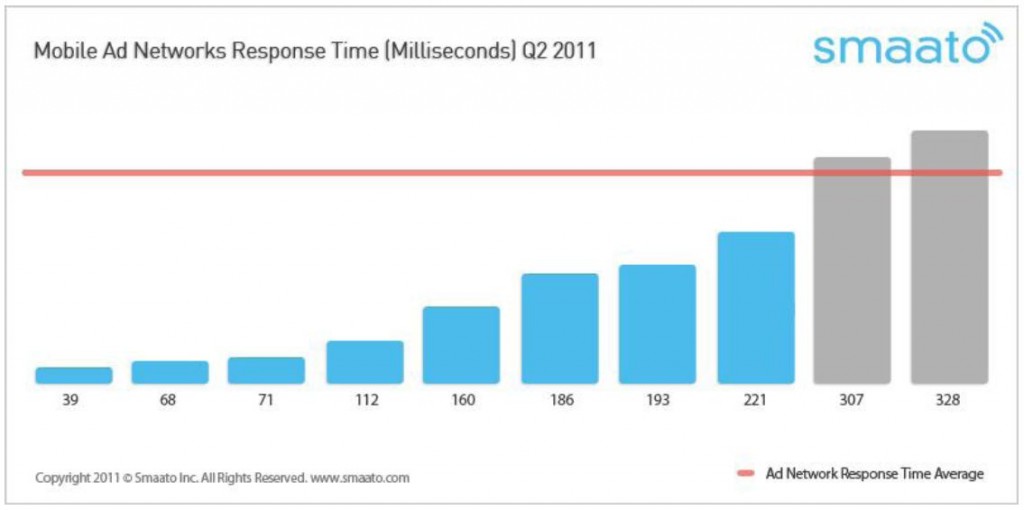

The final metric measured this quarter was ad network response time, which ranged from 39 to 328 milliseconds (msec) for the top 10 networks worldwide. This translated to an average response time of 290 msec.