It’s been pretty fascinating to watch Netflix’s growth from a company that Blockbuster laughed at in 2000 (when Founder and CEO Reed Hastings and former CFO Barry McCarthy proposed to Blockbuster management that they run its online brand) to the single largest source of web traffic in North America in 2011.

There have been quite a few hiccups and ups and downs along the way, as the on-demand video provider has struggled with Hollywood studios, succeeded as leadership has pushed its service onto TVs, game systems, and mobile devices — and more recently, re-focused on its streaming business.

Last week, that tweak to the business model saw a very public revision of the service’s pricing structure, a result of Netflix eagerly dividing its DVD rental and streaming services into two distinct businesses. In addition, Netflix created a whole separate management team for its DVD business, along with announcing that it would be offering its streaming plan for $7.99 and its DVD plan at $7.99, so that customers that want both will now have to pay $16 a month — a 60 percent price increase over its previous plan options. (For those who choose both streaming and physical.)

And, as you may have heard, customers were not happy. No, they were not happy at all. In fact, on the blog post in which Netflix announced said pricing changes, over 12,000 comments were posted (and that’s using Facebook’s commenting system, something TechCrunch readers are unhappily familiar with), most of them angry, and many in turn did their own announcing, saying they would be tendering their resignations, effective immediately.

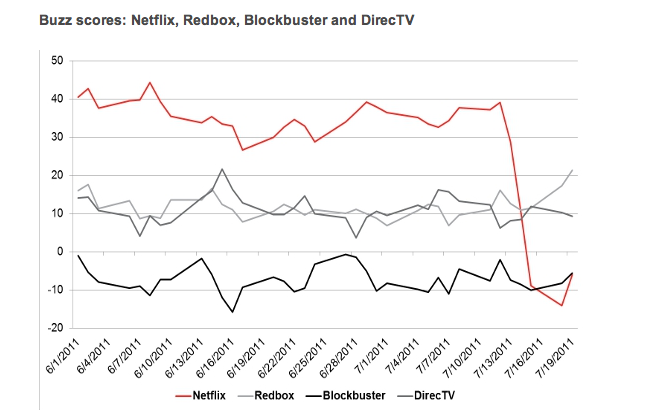

Of course, but, so what? Well, according to YouGov’s BrandIndex, in the ten days since Netflix made its price changes, the national perception of Netflix’s brand among adults dropped precipitously from a 39.1 on July 12th to -14.1 on July 18th, and currently sits at -6, putting Netflix in a virtual tie with Blockbuster. With a margin error of 5, that’s no tiny aberration.

BrandIndex calculated it’s score by asking Netflix, Redbox, DirecTV and Blockbuster customers about their impressions of each brand, and what they’ve heard about the brand via word of mouth, advertising, etc. BrandIndex Global Managing Director Ted Marzili told me that the scores reflect a sample size of about 15,000 respondents. Look out, graph below.

Of course, it wasn’t long before Blockbuster was courting potential Netflix defectors with a 30-day free trial. And though it doesn’t seem that Blockbuster has been reaping rich rewards from Netflix’s change, the company’s stock, which has performed very well over the last two years (and was at a 6-month high before the announcement on July 13th) has since dropped over 20 points. Some of that is natural — the stock was due for a slow-down — and of course some of it’s not.

According to GigaOM, Morgan Stanley has also stepped in with its own Netflix survey, which found that, in fact, 26 percent of Netflix customers would be canceling their subscriptions altogether. These numbers have since been toned down, as the initial emotional angst wears off, but either way it seems likely that Netflix will be suffering in subscription revenue in the near future.

Netflix has now forced many of its customers to make a choice between streaming and DVDs, because, after all, as Reed Hastings himself told Erick Schonfeld back in May, the future is in streaming, not in them plastic discs. I mean who uses CDs anymore, ya know?

There is always a backlash when a major service hikes prices, but it seems that Netflix might have employed a bit more market research beforehand, and perhaps if it had given current users some form of incentive over its new users, whether through discounts on a year long plan or not, might have been smart. (And in turn shown a little consideration for the loyal customers.)

What about a discount on a 2-for-1-type deal? After all, we’re living in the age of the daily deal, when consumers seem to expect a discount. Not to mention the fact that many wallets have undergone a significant squeeze over the last two years. Money is tighter than it was during the company’s early days, and Netflix might benefit from acknowledging that.

We’ll see how this all plays out. I expect Netflix’s brand perception and stock will be right back on track before long, but there’s always the chance that the hangover continues. And, perhaps more importantly — don’t laugh — will Blockbuster truly benefit as a result? How about Redbox? The local library?

Your thoughts?