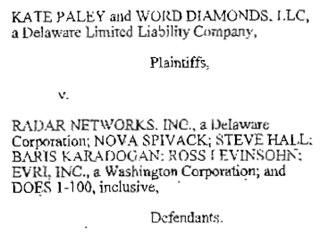

There’s a nasty, and very personal, lawsuit in progress between Radar Networks and a jilted investor, Kate Paley (daughter of CBS icon William Paley). The defendants include founder Nova Spivack, the company that eventually acquired Radar Networks (Evri) as well as investors Steve Hall, Ross Levinsohn and Baris Kardogan.

The company, known by most through it’s product Twine, was once doing quite well from an outsider’s perspective, but the reality, according to the lawsuit, is that the company was scrambling for ways to stay in business by 2008. The way that the company raised new money, and the details around its eventual sale to Evri, are a warning to any startup – sometimes it’s better to just shut down a failed company and move on.

The amended lawsuit is below. Plaintiff Kate Paley invested $5 million into Radar Networks in 2007 and 2008. Importantly, the second chunk, $3 million in 2008 – was convertible debt that would turn into equity only when the company raised a new round of financing of at least $4 million. The company did eventually raise more money, from existing investors, and converted that debt into equity. Apparently, though, only a small amount was raised and the company claimed the right to convert Paley’s debt because the total amount, including Paley’s $3 million, met the $4 million target. Paley asserts that the new equity had to equal $4 million without counting her $3 million. The new equity, from inside investors, was raised just days before Paley would have been able to call in her note.

What’s worse, after the financing and the conversion of Paley’s debt, the company raised new debt, including funds from Spivack, and that debt was paid off in the acquisition by Evri. Shareholders received nothing. Evri and Radar shared a common shareholder, Vulcan Capital, which raised additional issues of insider dealings.

There are lots of other allegations of broken promises and breached contracts in the lawsuit. The lawsuit alleges that Spivack painted a rosy picture of Radar Network’s prospects when raising money from Paley. But at the same time he was telling at least one existing investor that the company only had a month’s worth of cash left, and “we have to get a term sheet this month or the board will force a shutdown on us.”

Lots of companies spin tales to raise more cash and keep the dream alive for just a little bit longer. But it’s important not to say one thing to prospective investors and a different thing to existing investors. At least in writing – because it all comes out in the lawsuit.

Update: Spivak talks about the lawsuit here.