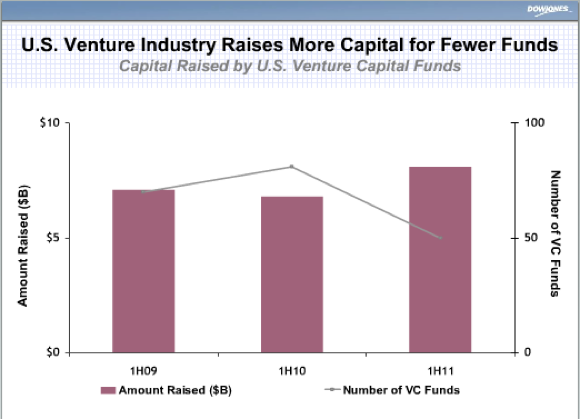

Dow Jones is reporting mixed numbers for venture fundraising this morning, releasing data that shows that capital raised for U.S. venture funds rose 20 percent over the same period a year ago, to $8.1 billion. But that stat comes with a caveat— the number of funds that held closings plummeted 38% to 50 funds. Seven firms were responsible for raising the bulk of the $8.1 billion, raising almost 80 percent of the total, or $6.3 billion. For basis of comparison, in the first half of 2010, 81 U.S. venture funds raised $6.8 billion. This trend was illustrated in this morning’s Thomson Reuters and the National Venture Capital Association report.

In the first half of 2011, a number of well-known VC firms closed significant funds. Bessemer closed a $1.6 billion fund, Sequoia closed a $1.3 billion fund, and Greylock added a $1 billion fund. In June, Accel closed two funds for a total of $1.35 billion in new capital. Andreessen Horowitz added a $200 million growth fund in April.

European venture funds didn’t perform quite as well in the first half of 2011, reporting the worst first half since 2004 in terms of fundraising. Fundraising for European venture funds declined 45% to $1.1 billion for 16 funds. During the same period last year, European venture funds raised $2 billion for 26 funds.

In terms of U.S. private equity, funds raised $64.7 billion in the first half, a 35% jump over the same period last year. European private equity funds collected $24 billion, a 48% increase over the year-ago period

Specifically, early stage funds saw a decline in funds raised in the first half of 2011. Twenty-eight early-stage funds raised $1.1 billion in the first half, a 48% drop since the same period last year. Dow Jones says if early-stage funds continue at this pace, they will collect less than half of the $5.2 billion raised in 2010.

By contrast, late-stage funds had their strongest first half since 2007. In the first half of 2011, seven late-stage funds raised $2.9 billion, well above the same period last year when two funds raised $150 million. Multi-stage funds raised $4.1 billion for 15 funds.