It seems that Venture investors are none-too-happy with current IPO activity. According to a study sponsored by Deloitte and the National Venture Capital Association released yesterday, over 80 percent of venture capitalists from around the globe believe “that current IPO activity levels in their home countries are too low”. Low enough, in fact, that it has investors worrying over whether or not it can sustain the venture capital industry.

It seems that Venture investors are none-too-happy with current IPO activity. According to a study sponsored by Deloitte and the National Venture Capital Association released yesterday, over 80 percent of venture capitalists from around the globe believe “that current IPO activity levels in their home countries are too low”. Low enough, in fact, that it has investors worrying over whether or not it can sustain the venture capital industry.

While it seems that investors and VCs tend not to agree on anything (ever?) and it’s thus a bit surprising to see 87 percent of U.S. investors agreeing that IPO activity is too low, it’s also important to keep in mind that this survey was given to investors in the spring. This was before Pandora and LinkedIn went public and bubbletalk was on the tip of everyone’s tongue; in fact, 2011 seems to be a pretty good year for IPOs and investors are encouraging startups to raise. (Before a potential bubble burst, of course.) So then, perhaps VCs should consider IPO rehab for their addictions? What do you think?

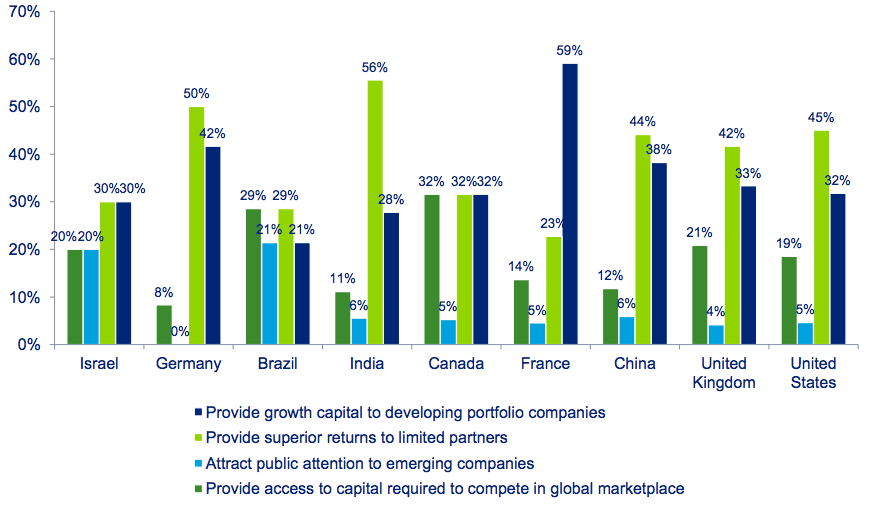

That being said, the study overwhelmingly found that the health of venture capital industries within each of these countries are suffering thanks to paltry IPO activity, and that the low level of activity is just not producing enough returns to provide growth capital for developing portfolio companies — nor are they meeting the expectations of limited partners.

While 91 percent of investors think that the U.S. domestic IPO market is critical to the health of venture capital, only 36 percent of U.S. VCs feel the same way about the rest of the world. That being said, maybe there’s some promise for the global market, as more than half (57 percent) of the 347 VCs surveyed are making plans to increase investments being made outside of their home countries over the course of the next five years.

As to what’s currently at the top of investors minds in regard to turning this trend around? Of the investors polled, 83 percent cited investor appetite as the most important factor for a strong IPO market, compared to the need for less cumbersome reporting for newly public companies (33 percent). The mention of fickle appetites as the top concern over regulation and reporting is very interesting, especially considering the SEC just voted today on the definition of what a venture capitalist is, as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was passed last year.

Though the details of the regulations will be announced next week, it looks like the government’s definition of venture capital will remain much the same, meaning the SEC will likely exempt VCs from most of the new reporting requirements that will be asked of hedge funds and other investors with more than $150 million in assets as part of this legislation.

In terms of areas that investors are currently most excited about, it seems that the cloud is on top, with 69 percent of VCs saying that they continue to be excited about cloud computing, whereas 65 percent are planning to increase investment in social and new media — with clean tech coming in next at 62 percent.

Interestingly, 54 percent of those polled said they would be putting additional funding into healthcare services, which is great to see. There seems to be renewed interest in healthcare IT and medical services, especially considering the government continues to push for reform in the healthcare industry. Nice to see healthcare avoiding becoming one of the sectors least appealing to investors, like semiconductors which came in at 13 percent and telecom at 15 percent.

With there being a lot of coverage swirling around the topic of whether or not there’s a bubble, multi-billion dollar valuations, and a struggling IPO market, quite a few have weighed in on the matter. Mark Suster’s post yesterday is not to be missed. One of the charts in Suster’s post shows that VC-backed IPOs jumped in 2010, and though it doesn’t include numbers for 2011, there’s a chance we may even get to a 10-year hight. Thankfully, I’m not a betting man. And, for good measure, because you need your VC vitamins, you should also check out Fred Wilson’s response.