By the end of this year, an estimated 2 million households in the U.S. will have abandoned TV for the Web, cutting the cord with their cable companies. This estimate comes from Convergence Consulting Group, a Toronto-based research firm with a new report on The Battle for the American Couch Potato. That 2 million is up from the 1.6 million it was estimating a year ago, but it is still rather small and the number of cord cutters may very well have peaked last year as cable companies begin to fight back with TV Everywhere offerings.

Nevertheless, the big beneficiaries of cord cutting are Netflix, Hulu, and Apple TV. They benefit even if people keep their cable but add Internet TV streaming or downloads to their viewing repertoire, as is much more common. According to Convergence , 18 percent of viewers in the U.S. watched free, full episodes of TV on the Web last year, and that is growing by a percentage point every year:

Estimated Percentage of Average Weekly US Viewers That Watch Free Broadcast and Cable Network Online Full Episodes, 2009-2012

2009—16%

2010—18%

2011—19%

2012—20%

Streaming has helped Netflix in particular in terms of driving new subscriber growth, and it is also arguably a gateway drug to cord cutting. Convergence estimates that Netflix revenues from online-only subscribers in the U.S. will grow from $172 million this year to $578 million in 2013. And if you add in Hulu Plus, the combined streaming revenues from both companies will reach an estimated $800 million in two years.

Netflix may be paying up to be able to stream TV shows and movies left and right, but it is still paying only a fraction of what the cable companies shell out for programming. For instance, Convergence says that this year Netflix will double the amount it is estimated to pay for programming to $1.1 billion, while Apple will pay about $450 million, and all the other online providers will pay almost $400 million. Not quite $2 billion total from the Interent for TV and movie programming rights. Meanwhile, traditional TV access providers are expected to pay $38.7 billion for programming.

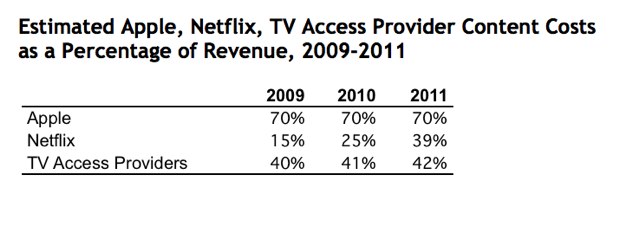

On a per subscriber basis, last year Netflix only paid one tenth the amount for programming ($34/subscriber) as did cable and satellite TV providers ($359/subscriber). As a percentage of revenues, it is approaching what TV access providers pay for content. Last year it was 25 percent of revenue going towards content, and this year it will be an estimated 39 percent, versus 42 percent for cable companies (and 70 percent for Apple TV). But the absolute gap will remain massive for the foreseeable future.

Photo credit: Flickr/Schmilblick