Yesterday, at the Goldman Sachs Technology and Internet Conference in San Francisco, Googler and PayPal founder Max Levchin and Benchmark GP Bill Gurley discussed “game-changing technology” and the future of the Web. Emblematic of today’s mindset, they attacked this rather large topic by comparing the strengths and objectives of Google and Facebook, using the latter’s jaw-dropping stats (500+ million users, 1 in every 13 people on Earth logs into Facebook each day) and its promotion of the social graph as a measure of what’s to come.

Yesterday, at the Goldman Sachs Technology and Internet Conference in San Francisco, Googler and PayPal founder Max Levchin and Benchmark GP Bill Gurley discussed “game-changing technology” and the future of the Web. Emblematic of today’s mindset, they attacked this rather large topic by comparing the strengths and objectives of Google and Facebook, using the latter’s jaw-dropping stats (500+ million users, 1 in every 13 people on Earth logs into Facebook each day) and its promotion of the social graph as a measure of what’s to come.

Levchin said that Facebook is fast becoming the new social white pages, i.e. when you don’t know where someone is on the Web, you go to Facebook to find and connect with them. But, in addition to that, he says, the social networking giant is really “the rich white pages,” where you not only locate someone but have the added benefit of finding out what they like, what they read, what their favorite movies are, and so on.

Facebook looks to capitalize on this by “renting” their graph to websites through Facebook Connect, which, he says, “is exceptionally powerful” and in turn may lead to their successfully “replacing core messaging services.” And if Facebook does become the Web’s next communication platform, then it will “be undoubtedly in the running for the most valuable company in the world.” Considering the importance of communication in our digital world, I think few would disagree with his conjecture.

(Though, as an interesting side note, Business Insider published a post last night on this panel and quoted Levchin on his Facebook hypothesis. Google responded directly to BI’s post saying that Levchin was misquoted and implying that he wouldn’t go and give Facebook those kind of props. Well, I was at the panel and have watched video of it several times, and the quote above is exactly what he said. Et tu, Levchin?)

Drama aside, let’s say for a second that Facebook doesn’t become the next Bell Atlantic. How then will Facebook grow into that uber valuable monstrosity? Zuckerberg has repeatedly said that the social graph at the core of their business is integral to the success of Facebook — and the future of the Web.

To be fair, Levchin isn’t blindly drinking the Facebook Kool-Aid, citing demand generation and demand discovery (search) advertising as a prime example of the limitations of the social graph. “Social graph signals have not been helpful in optimizing advertising that is related to search,” he says, which suggests that off-handedly proposing that Facebook will be just as big as Google in every way is — basically — wrong. Considering the multi-billion dollar discrepancy in revenue, Facebook continues to confront different challenges in monetizing at scale. Ultimately, he says, Facebook as a web property is not “going to compete with Google — at least in the near term — at all.”

In support of Levchin’s point, Gurley recounted the similar example of how Netflix had originally implemented a social graph model into their movie recommendation system but quickly found that it wasn’t nearly as effective as other types of recommendation algorithms. For many, it would seem intuitive that socially-generated recs would be great indicators of what we’d like, but it’s also true that most of us hang out with friends that have at least a few special hobbies or passions that are very different from our own.

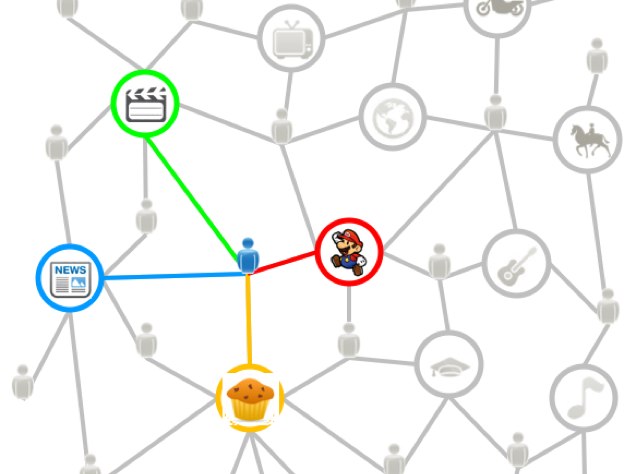

As such, what everyone in Silicon Valley and “Venture Land” conceive of as the real game-changing model involves capturing and capitalizing on the “interest graph,” he says. The company that succeeds in doing so would be “close to the Google search paradigm because it would be right in line with demand generation and with discovery that relates to product purposes.” Thus, it is the interest graph that defines the middle ground between Google and Facebook — between search, advertising, and the social graph.

I think we can be sure that whoever can collect a record of your current interests and package them for advertisers stands to make a lot of money. Levchin says that Twitter may end up being a more advantageous platform to advertisers because it allows you to follow a brand and get realtime information and updates — through brand discovery and celebrity discovery — which is more likely to be informative than what you get from your friends, who may not be experts. Twitter has said that it believes that it has control over the interest graph, but status updates don’t really provide the depth and contextualization that is really needed. Of course, the interest graph isn’t exclusive. Facebook, Twitter, and startups like Gravity are hoping to capitalize on it — though something tells me that Levchin wants to bring a slice of the interest graph to Google as well.