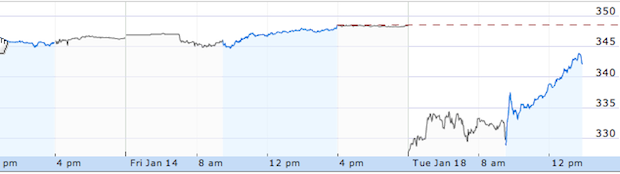

As anticipated, shares of Apple’s stock took a massive — and I do mean massive — plunge this morning when the stock market opened. How massive? Roughly $20 billion was wiped off of Apple’s market cap instantly as shares fell over 20 points. But almost as remarkable is the rally that Apple has seen since then. Shares are now up about 15 points from their lows this morning and $15 billion of that $20 billion loss has been added back.

Why the rally? Because after the closing bell today, Apple will announce their Q1 2011 earnings — the quarter that includes holiday sales for the company. Pretty much everyone is anticipating a huge quarter for Apple — undoubtedly, their biggest yet. And investors are clearly doing some last-minute jumping on the bandwagon realizing that revenues will offset uncertainty — at least for today.

The larger question, of course, is whether Apple’s stock is able to stay in the stratosphere after today. Guidance will obviously be a big part of that, but Jobs’ health will also likely remain a factor. When he took his last medical leave of absence in 2009, Apple’s stock took a pounding, and it took quite a bit of time for it to rally back (though, to be fair, there was also an overall economic downturn happening at the time). But eventually it did when it became clear that Apple wasn’t missing a beat with COO Tim Cook at the helm.

Cook has once again been tapped by Jobs to lead the day-to-day at Apple in his absence, though Jobs will stay on as CEO and will still apparently be involved in all major strategic decisions.

Calculated or not, Apple’s move to disclose Jobs’ departure on a U.S. holiday when markets were closed and the day before earnings were to be announced was clearly a smart move from a purely financial perspective.

Even after the $20 billion plunge this morning, Apple remained the most valuable technology company from a market cap perspective. They also remain the number two publicly traded company overall behind only Exxon — which are the only two over $300 billion.

We’ll have more on Apple’s earnings today after they’re announced this afternoon.