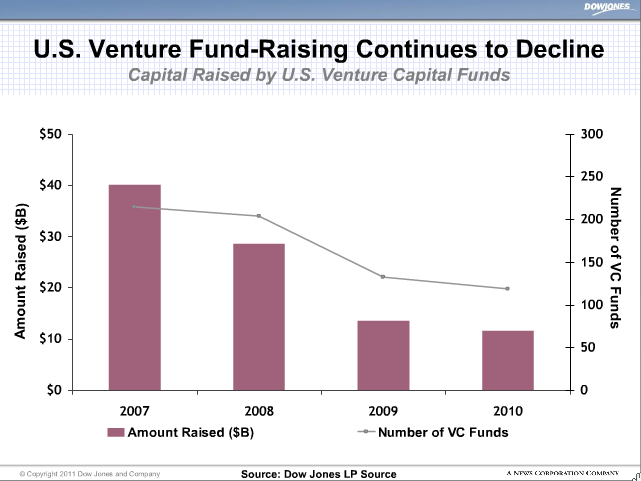

As we all know, the U.S. venture capital industry is contracting. New data out this morning from Dow Jones LP Source confirms the trend. In 2010, U.S. venture capital funds raised $11.6 billion, down 14 percent from 2009 (and down 70 percent from the $40 billion raised in 2007). The amount marks a seven-year low for the venture capital industry, as limited partners look elsewhere for outsized returns.

Things weren’t looking any better in the fourth quarter, when fundraising was down 48 percent to $2.4 billion among 15 venture funds. Early-stage and seed funds are the new hotness, however, as venture firms try to identify winning startups at inception. Of the 15 funds, ten were early-stage, raising $1.5 billion in the fourth quarter.

Among venture funds, the strongest were still able to raise more capita last year. Institutional Venture Partners raised an oversubscribed $750 million fund, August Capital raised $650 million, Union Square Ventures is in the midst of raising a new $200 million fund.

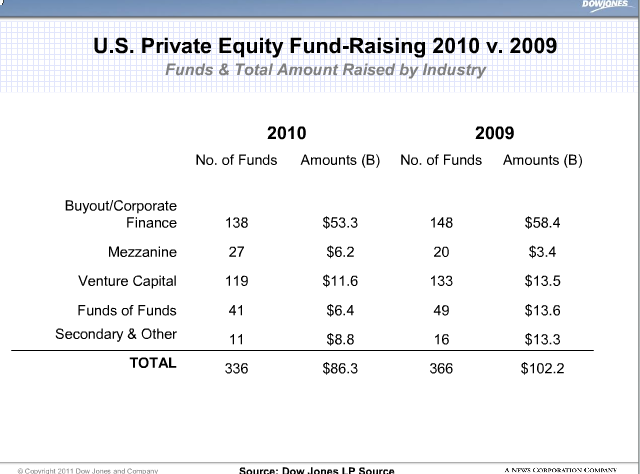

Overall, fundraising for private equity funds (of which venture capital is a subset) was down 16 percent for the year to $86.3 billion, but saw a 19 percent jump in the fourth quarter due to strength among buyout, distressed debt, and mezzanine funds. You can see the breakdown in the chart below.