Editor’s note: Guest writer Rory O’Driscoll is an entrepreneur-turned-venture capitalist. He is a Managing Director at Scale Venture Partners. You can follow him on Twitter at @rodriscoll and blogs at VCMatters.

I simply love Goldman Sachs. The Facebook deal is a brilliant poke in the eye for just about everybody, and proof, yet again, that money, like water, finds its own level. If there are buyers and sellers to be matched, and a fee to be made in the process, the fine folks at Goldman Sachs will figure out how to bridge that gap. So much the better if there is regulatory friction to arbitrage against, it simply raises the fee.

For the last seven years, the venture capital industry has been saying that the IPO process is broken and startups are the losers. In a fine display of Wall Street’s can do attitude, Goldman has gone and produced an alternative to an IPO; one where the clear winner is the startup. Make no mistake; this is a great result for Facebook. Consider the alternative. Going public is hard, and being public is harder. This is true for a company like Facebook, not because of the cost of Sarbanes Oxley compliance, which would be more than manageable, but because of the insidious nature of being public and having a focus on quarterly earnings, governance and the stock price. No matter how hard you try to avoid becoming short-term focused, the constant drip of analyst meetings, quarterly updates and daily stock price tickers takes its toll. Your earliest and best employees, fully vested and now fully liquid, leave, and instead of building a company, the CEO is getting on quarterly analyst calls.

The best reason to go public was to get the money. Conventional wisdom used to say that the only way to raise $1 billion-plus, at an attractive valuation, was to provide investors in return the transparency and the liquidity that being a publicly traded stock entails. The company puts up with the analysts, the information requests and the quarterly filings in return for getting the cash. Goldman has given Facebook all of the benefits and none of the negatives of a public offering. They should have a happy client.

It is of course axiomatic that the other clear winner here at least in the short term, is Goldman Sachs. They have made a bet with their money that will either work or not in the next two years, but along the way they will make many hundreds of millions of dollars in fees. From all accounts, their retail client base is happy to be offered the chance to invest in Facebook, and Goldman will make a 4% fee and a 5% carried interest on the deal. If they sell enough, and can sell down some of their own piece, they can be money-good on Day One. The demand sounds like it is there.

The clear losers here are the stakeholders in the IPO process, namely the exchanges (NYSE, Nasdaq), the SEC, and arguably the large institutional investors who are restricted to investing in public securities. The dearth of venture backed IPO’s in the last ten years can be looked at in reverse as a loss of market share for the “IPO and beyond” team. There are numerous privately held companies that would, in an earlier time, be public and want to be public (because the Goldman Facebook option is not available to them) and are instead still private, because the IPO process is hard and the public market investors have been gun shy. Although this has been presented as a negative for the private investors, the reality is that it is arguably a bigger negative for the exchanges and investors. The exchanges have left trading fees on the table, and the public investors have not participated in the creation of value, that has instead taken place on the private side. Anyone with a 401k should be wishing that Facebook had gone public at a $5 billion valuation three years ago. The subsequent $45 billion of value creation would be dispersed across thousands of 401k’s and not concentrated here in Silicon Valley.

What about the new investors here, are they winners? The honest answer is who knows and who can know? Would Facebook trade today at $50 billion in an IPO? I don’t know. Could it be worth $100 billion in the future? Quite possibly. All you can know for sure is that, because this investment is illiquid and the company will not be filing quarterly financial updates, the investors will not suffer the torture of knowing their investment is “under water”, if such should happen, along the way. No news means no bad news. Not, it would seem, that some of the investors care. In a wonderful quote from the Wall Street Journal a Goldman client said; “It’s hard to imagine how this thing is going to make money, still the deal is an attractive opportunity”. All the SEC regulation in the world cannot save people like that if they don’t want to be saved. Maybe it is best that instead, they just enjoy the privilege of being a special Goldman client.

The reality is that this is not a trend, it is a singular event. There are not ten Facebooks out there, instead there is, roughly one Facebook every ten years. As a small part of the fun of being an utterly dominant company, each decade’s winner gets to slap around the IPO process. Microsoft made the underwriters cut their commission, Google ran a Dutch Auction, Facebook for now has contracted out of the process entirely. None of this represented a trend that others could follow. For almost every other deal out there, this kind of financing is not an option and the IPO process will continue broadly as before. For those of us in the investing business who did not invest in Facebook, the only good news from this could be if the competition does sharpen the “IPO and beyond” team up a bit. The only bad news could be if the SEC, in an understandable effort to amend the rules to prevent this from happening again, changes them in such a way as to impact venture firms with more typical LP/GP structures. It shouldn’t happen, this really is a one off, but the SEC has got to be thinking dark thoughts about expanding the rule book.

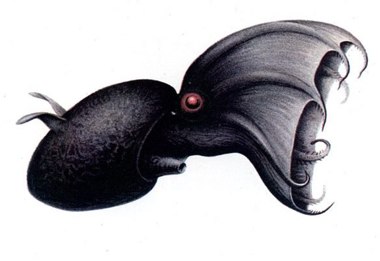

Failing either of these outcomes, I am left saying “bravo” to the great vampire squid and the unstoppable chutzpah they have shown.

Image credit: Goldman Sachs “Vampire Squid” Moniker Courtesy of Matt Taibbi in RollingStone