The following is a guest post by David Dalka. Dalka is a digital business strategist and keynote speaker who was a member of BlackRock (BLK) during its hyper-growth phase of 80 to 800 people. He is a top ten contributor to CrunchBase, strategist to senior executives on how digital marketing tactics are transforming business strategy and revenue generation, blogger and is currently working on a nonfiction business book proposal. According to TechCrunch Editor Michael Arrington, Dalka currently lives in a location of “horrendous weather eight months out of the year”. (Editor’s note: Maybe you can entice him to move somewhere else? Seriously, we really do pity him.) Photo courtesy of 2010 Internet Hungary conference.

The following is a guest post by David Dalka. Dalka is a digital business strategist and keynote speaker who was a member of BlackRock (BLK) during its hyper-growth phase of 80 to 800 people. He is a top ten contributor to CrunchBase, strategist to senior executives on how digital marketing tactics are transforming business strategy and revenue generation, blogger and is currently working on a nonfiction business book proposal. According to TechCrunch Editor Michael Arrington, Dalka currently lives in a location of “horrendous weather eight months out of the year”. (Editor’s note: Maybe you can entice him to move somewhere else? Seriously, we really do pity him.) Photo courtesy of 2010 Internet Hungary conference.

About a month ago there was a loud outcry when Facebook inexplicably introduced a smaller font size to its News Feed. The lack of communication from Facebook while making a significant change is sadly nothing new. You could tell that the angry and highly upset Facebook users that day knew instinctively that this event was not in their best interest.

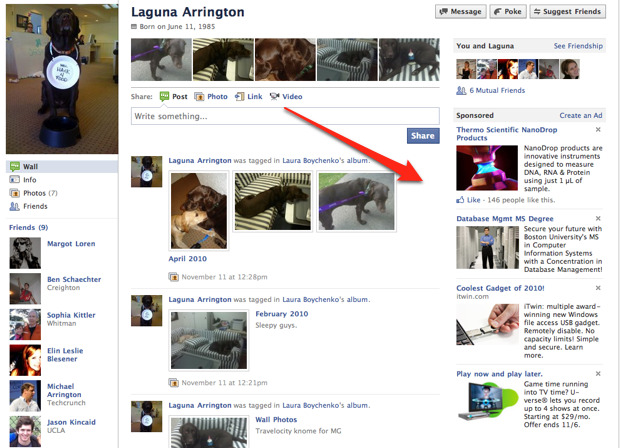

A month later, hidden behind all the public relations hoopla regarding Mark Zuckerberg’s chat with former President Bush and appearance on 60 Minutes, I finally realized the motive for last month’s text size reduction. It appears that the smaller text size was set up to pre-condition users for the larger coverage area of ads on the screen by making the ad columns wider, thus allowing more ads to be shown above the fold and closer to your newsstream. Do they actually disrespect your personal space that much? Is this how little (pun totally intended) Facebook thinks of you, their userbase? Unfortunately, the answer seems to be yes.

This conversation is about much, much more than Facebook. Linkedin reducing your ability to search your social network, Yelp reportedly using high pressure tactics to sell ads, Twitter’s promoted tweets, etc. Only you have the power to end this cycle of abuse by social networks and it is time for the web community to stand up and shout that they are sick and tired of constant terms of service changes, privacy changes, steps backward in usability that degrade our mutual experience, comfort level with the sites we use and our enjoyment of the web. Some people like Shel Israel have asked that Mark Zuckerberg step down as CEO of Facebook. That is not the point of this post. The point of this post is to help social media users understand how startups lacking well thought out and viable data, business and revenue models are the root cause of the symptom of constantly oscillating user experiences. It is my hope that you will reject the new profiles.

It appears that the changes in screen real estate usage are between the old Facebook profile and the new Facebook profile are significant. TechCrunch techs estimated the pixel usage changes for this purpose. It’s tricky to measure the differences — with the new profile Facebook has actually adjusted the total size of the profile (increased by around 20 pixels), and has tweaked all of the profile elements, including photos and the Wall, and there’s also the issue of how much whitespace to measure. But what is clear is that there has been a significant reduction in your social media experiences with your friends.

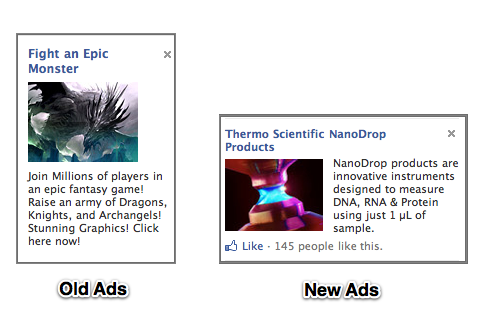

In the old version, the ads had a photo with text underneath and now the text is alongside the photo. The old edition had an ad width of about 160 pixels while the new edition now clocks in around 245 pixels, a ~53% increase in ad width – yikes! The ads are now around 140 pixels high compared to around 230 pixels previously. While the overall size of the ads has not changed very much, they appear denser and more of them can now be seen above the fold. Amazingly, the new ad sizes have been mentioned favorably in certain circles.

Even more interesting is that the ad text size is the same as before while your wall font is smaller, which means you are more likely to be distracted by the ads. An offline analogy might be when a television channel turns down the volume of their shows, while keeping the volume of commercials higher.

As I stated in a recent podcast interview with Peter Clayton, regardless of whether you are an individual or managing a business, you do not own your terms of service on a social networking site. Think of it this way, a social networking profile is like an apartment, while a web site built on a domain you own is property that belongs to you. You don’t see too many people rent an apartment and then invest $20,000 in remodeling the kitchen do you? This is because the improvement in property is not owned by the individual and the future values of the improvements are highly uncertain.

The same is true of social networking sites. This is typically not seen as a problem by individuals. It also goes unnoticed by most traditional brand marketers as they are used to expiring, non-measurable media in the pre-Internet era of marketing and often not held accountable by senior management. Once fully understood by senior business executives, the microeconomics of marketing channels has emerging implications for enterprise business strategy, marketing budget resource allocation and eventual redefinition of the skill sets required to lead businesses into the future successfully.

The first phase of the web focused too much on business ideas without technology execution, the web 2.0 phase was skewed towards technology without a tight correlation with business results. For our economy to thrive and the USA’s standard of living to be maintained, it is important that the proper balance between business monetization model and technology to ultimately occur sooner rather than later.

Here is a brief list of concepts that should be considered to make our society conserve scarce capital and allocate funding resources efficiently:

– Users should demand that social networks stop abusing their rights – with constant nontransparent terms of service and user experience changes, social media users are being whipsawed. This is not sustainable. It starts with you demanding better treatment not only from Facebook but also from all social networks.

– Venture capital should require viable revenue model path explanations – The Businessweek article, The “Lost Decade” for Venture Capital states,

Unfortunately, they ran into a giant negative coin flip—everything was delayed a lot longer than they expected. Thus all the money-eating startups, and the general reluctance of VCs to stick their neck out.

It is my belief that is a symptom of certain venture capital professionals not focusing tightly enough on data models and potential revenue models prior to funding rounds. If I’m ever a limited partner at a venture capital fund, one of the questions I’ll be asking is “Please explain three to five potential revenue model paths that could work with your concept?” I don’t expect them to be right and I don’t actually expect them to be the one that works out. What I would expect is for the entrepreneur to have a focus on executing with low cash burn rates and have a passion for solving the monetization problem.

Stated another way, if they aren’t focused on building a sustainable revenue model as a core passion before the venture capitalist writes a check, when will they ever be? Think about more companies like TC40 company mint.com. Companies should have their data and potential monetization paths organized prior to funding events occurring. To be clear, these do not need to be implemented on day one; however the infrastructure of the startup should be properly designed to enable this data and revenue generation vision from day one.

Yes, there are exceptions to this rule. For example, Sergei and Larry likely never envisioned Adwords when they started Google, but that was a one in a billion exception. My point is that it is the exception, not the norm. Valuations not based on actual cash flows and/or audited revenue numbers need to be viewed with a much higher level of scrutiny.

“Google, Yahoo!, Microsoft, Ebay will buy it ” is likely NOT a valid business model any longer – eBay bought stumbleupon.com for $75 Million then spun it off for $29 million two years later. eBay also disposed of a large chunk of Skype after not meeting the acquisition objectives for it. TechCrunch has written in detail about this previously. Kudos to eBay CEO John Donahue for recognizing the issues and having his management team take swift action to put closure on the issues. It would appear that the days of eBay buying things without revenue models is now behind it.

The ongoing drama involving MyBlogLog and Delicious could also be attributed to lack of a viable monetization model before acquisition or Yahoo’s inability to change the data model to create one after acquisition. Delicious, once the data was normalized and reconfigured, had realistic potential to be an awesome blog content relevancy engine. Unless something major changes, it would appear that Yahoo! will not be buying any non-revenue generating start ups anytime soon.

Google walked away from buying Digg as reported by TechCrunch. Could it be that Google’s acquisition team saw a Stumbleupon or Delicious type scenario on the horizon? We’ll never know for sure, but it’s an interesting question to revisit at this juncture.

To prevent future situations like this, the startup community should encourage the design and funding of companies with long term sustainable data and revenue models that respect the user experiences, companies capable of standing on their own two legs and having viable initial public offering (IPO) potential that could withstand the test of a financial audit.

– For the same reasons, Google should resist overreacting to social media – To be clear, this problem affects many established companies investing in new projects.

Nick O’Neil wrote a post in August entitled, The Center of the Google vs. Facebook War: The Like Button, he stated,

By now it has become well known that Google is planning a competitor to Facebook. While many believe that it may be too little too late for Google, the reality is that it’s a matter of survival for the company at this point.

Sometimes social media hype prevents analysis of the actual facts. Google appears on track to exceed $8 Billion dollars in net income, an increase over 2009’s $6.52 Billion in net income audited by Ernst & Young. One of Google’s risks is new innovation from within that disrupts its primary cash cow and as such, Google will likely survive just fine regardless of anything Facebook does and Google doesn’t match with a reaction. In fact, it likely has a higher chance of survival.

To be clear, investments in startups without a focus on monetization from the start are having cross over effects in the mainstream business community. Executive leadership teams in companies both large and small need to align their business strategy and marketing budgets to the new realities of content and communication in our society to prevent future business failure. Corporate marketing budget allocation and executive team skill selection are way behind these emerging realities. This needs to change.

When a start up focuses on viable revenue models and provide a valuable, long term service from inception everyone wins – users, businesses, investors and the overall economy. It is vital to a focus on funding concepts with potential long-term revenue models capable of creating sustainable value to customers and long term cash flows that can withstand a financial audit, provide a valuation based on valid fundamentals of finance and capable of becoming companies capable of initial public stock offerings. The alternative path is a never ending cycle of takeover, heartbreak and destruction.