When an analyst asked Steve Jobs during Apple’s last earnings call what he plans to do with Apple’s $50 billion in cash, he replied that he wants to keep Apple’s “powder dry” in case “one or more strategic opportunities . . . come along.” Speculation started immediately about who Apple could buy with all that cash: Facebook, Sony, Adobe?

But Apple never makes huge acquisitions. It tends to make smaller talent and technology acquisitions instead.

Apple’s rumored interest in mobile payments startup BOKU would fall into that pattern. The fact that it is in M&A discussions with BOKU doesn’t mean a deal is going to happen, but it does mean that Apple is very interested in mobile payments.

Whether it builds or buys, or does a little bit of both, mobile payments could be a huge opportunity for Apple within the next few years.

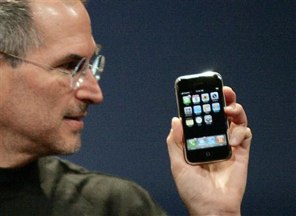

Imagine if your iPhone became your wallet? The dream of turning mobile phones into wallets has been pursued for a long time by many companies, but Apple is in a unique position to make mobile payments more mainstream. Apple already handles payments very well through iTunes, which boasts 160 million active credit card accounts. PayPal only has 90 million.

Payments will start with digital goods—songs, movies, apps and in-app purchases. Apple already does all of this today through iTunes, which is one of the best micro-transaction aggregation systems around. What if you could charge those micro-transactions to your phone bill just as easily as you could to your credit card?

Then, it would be even easier for Apple to sell apps, songs, and movies through iTunes, especially to younger customers or those in developing countries who may not have a credit card. (BOKU’s strength is those carrier relationships).

Over time, those payments could spread from digital and virtual goods to real-world purchases. Apple is not thinking about adding a near-field communications (NFC) chip into the next iPhone for nothing. The more people use their iPhones to actually purchase goods, the more indispensable it will become.

Would Apple ever take the next logical step and become payments processor itself? If it did that, it would be able to cut out the carriers from the mobile payments equation. Swap the carrier bill with iTunes, and those fees the carriers charge to process micro-payments go away. Apple can start charging those fees instead or pass the savings along to their iPhone-toting consumers, who will then be able to spend more on stuff in the iTunes store and elsewhere. Your iPhone could be your wallet: Never leave home without it.