Just about every evening investor Dave McClure sends me an email pitching one of his startups for a story. Company X just got a user! That sort of thing.

Just about every evening investor Dave McClure sends me an email pitching one of his startups for a story. Company X just got a user! That sort of thing.

Tonight though the pitch was a little more interesting. Credit Karma, a startup we first covered late last year, now has more than 2 million members. Revenue is “8-10X higher than last year,” but without a hard number and my understanding that last year they had zero revenue makes that somewhat less impressive.

But the service is really cool. I have recently been in credit card hell. Chase dropped my credit limit on my United card to absolutely nothing for no reason at all last year, and won’t increase it. I’ve also been declined by American Express, repeatedly, for a Starwood credit card.

Yeah, I know. Boo hoo. But the point is I need a credit card for travel and to otherwise live my life.

I’m too lazy to ever check my credit score, but Credit Karma made it easy enough even for me. I gave it just about all of my personal data and hit submit. Then, zap – I see that my credit score is 748, which is considered “excellent” and in the 78th percentile. “Given that you have a high credit score lenders should be able to conclude that you are capable of repaying your debts,” says Credit Karma, and I wholeheartedly agree.

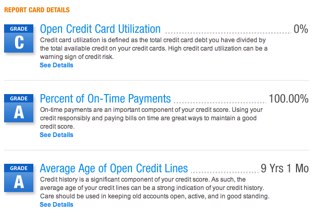

There’s more. I can also see a detailed report on how my credit score is calculated.

Open Credit Card Utilization: 0%. That’s bad, and I get a “C”

Percent On Time Payments: 100%. That’s good. An “A”

Average Age Of Open Credit Lines: 9 years, 1 month. An “A”

Total Accounts: 15. That’s bad, too few, no idea why, a “C”

Hard Credit Inquiries: 6. That’s me trying to get Chase and Amex to give me credit. Too many, a “C”

Total Debt: $0. Apparently that’s bad too.

If I owned a bank, and I hadn’t yet embezzled all of my customers’ money and moved to Brazil, I’d definitely give me a credit card. All the bad stuff is that I’m not actually using credit, or have too few credit accounts, and don’t have any debt.

I mean seriously Amex. Give me a damn credit card. Whatever you’re using to figure out who gets one is really broken.

Update: Hilarious.