With 13 billion dollars in mutual fund fees generated each year, so much about the investment process is made needlessly complicated by companies who want to sell you funds. Y Combinator-backed FutureAdvisor, which launches tonight, wants to help.

With 13 billion dollars in mutual fund fees generated each year, so much about the investment process is made needlessly complicated by companies who want to sell you funds. Y Combinator-backed FutureAdvisor, which launches tonight, wants to help.

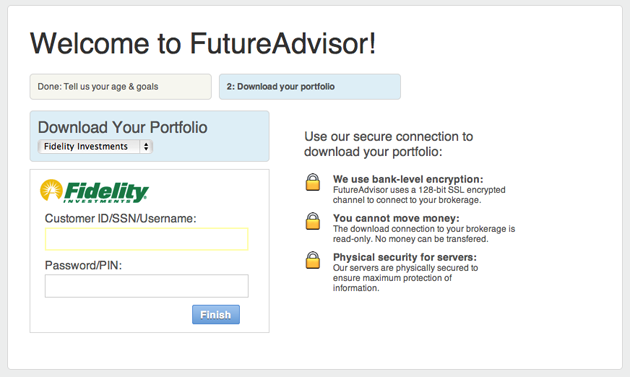

The company likens itself to a Mint for retirement investment, but unlike retirement calculators from funds like Fidelity and Schwab, the web app aggregates all your independent mutual fund data into one place. And, unlike web services Betterment, Plant.ly, and the stealth Blueleaf, FutureAdvisor takes into account what stocks and funds you already own including your 401k.

“We want to provide you with the minimum number of steps to get the most bang for your buck,” says co-founder Bo Lu.

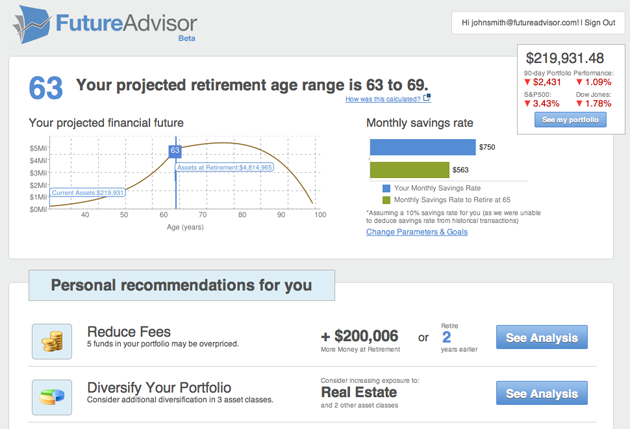

FutureAdvisor imports your investment info from multiple sources, focusing on serving up your retirement plans in convenient and easily understandable graphic formats. You can also enter in data about your age and retirement goals and the FutureAdvisor algorithm provides you with options for asset allocation, how to optimize your return, and, if you currently work at Google, Microsoft or Intel, the app can tailors its advice within your 401k’s limits.

From founders Lu and and John Xu, “We eventually realized that most of our friends were asking the same questions (how should I allocate my money?), making some of the same mistakes (buying high-fee funds), and that the best way for us to help everyone was implement the wisdom of index investing in software.”

Bo Lu and Jon Xu’s future plans include providing people with the data they need to make better investments, and eventually complete long term goals like buying a house or paying for their children’s education, “You used to have to be rich and talk to some guy in a suit, now you just have to come to our website.”

Photo: Mark Hardin