BillFloat, a San Francisco-based startup incubated by PayPal and Venrock, has raised $4.5 million in a Series A round led by First Round Capital, with renewed participation of PayPal and Venrock and joined by early-stage funds and angel investors such as Jeff Clavier’s SoftTech VC, Ron Conway’s SV Angel and Mint.com board member Mark Goines.

The company soft-launched last week with a proper website and is today for the first time presenting its value proposition to the world. In a nutshell, the company aims to help people get their bills paid in time.

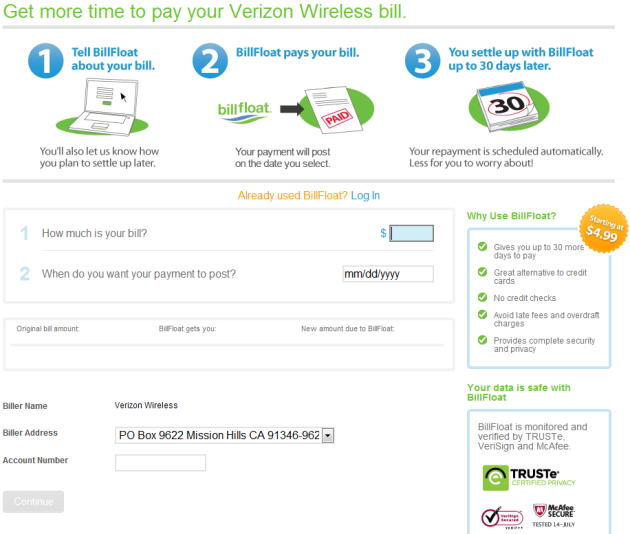

Here’s how that works: you go to the BillFloat website and select one of the 3,000 (United States-based) billers currently in the BillFloat database, ranging from phone, cable and satellite providers to utility, housing, leasing and insurance companies.

Next, indicate how much your bill is and when it needs to be paid, fill out some personal details, and BillFloat will take care of it, for a fee relatively small in comparison to what most banks and short-term lenders tend to charge for time extensions (from $4.99 and upwards per bill depending on how high the amount is). You get more time to see to it you can clear the bill payment, and you can repay the micro-loan in the 30 days following the scheduled payment.

It’s effectively a micro-credit provisioning play, but you needn’t worry about credit checks, as BillFloat skips that part. To mitigate the obvious risks that come with that approach, the company says it has a ‘decisioning engine’ in place that runs in the back-end to avoid too many people not paying back the micro-loans in time, or at all.

It wasn’t crystal clear to me how this works, exactly, but that engine better be top-notch since it has the potential to kill the venture before it even gets off the ground properly.

Ryan Gilbert, BillFloat co-founder and CEO, says:

“BillFloat has entered the micro-credit market with a clear focus on delivering the best way for consumers to get ahead of their bill payment obligations. This allows consumers to build and maintain good credit scores and graduate to traditional financial offerings. We will provide consumers relief from the $32 billion in overdraft protection, non-sufficient funds, and late fees that are paid by American families every year.”

“We know from our own consumers, and data from the FDIC and Center for Financial Services Innovation (CFSI) that 47% of the $50 billion in high cost loans, borrowed by consumers every year, is used to cover basic living expenses. BillFloat’s provides a more affordable and reliable alternative for bill payment”, added Sean O’Malley, BillFloat’s other co-founder.

What I like about the BillFloat model is that its system can be made available directly on billers’ websites, effectively lowering the barrier to entry and the cost of customer acquisition.

The startup says it is also partnering with financial services partners including pre-paid and debit card issuers, payroll services and walk-in payment centers. Obviously, PayPal integration is high up on the to-do list.

Is this something you see yourself using?