When you follow someone on social investing site Covestor, you get to see all of their real trades. But now, for some superstar investors on Covestor, following them can also have financial implications. Earlier today, Covestor merged its main social investing site with Covestor Investment Management (cv.im), a separate service it launched nearly a year ago to allow individual investors to mimic the trades of professional and successful individual investors with a proven track record. Now, $100 million worth of executed tracked trades later, Covestor is folding the investment management service into its main site.

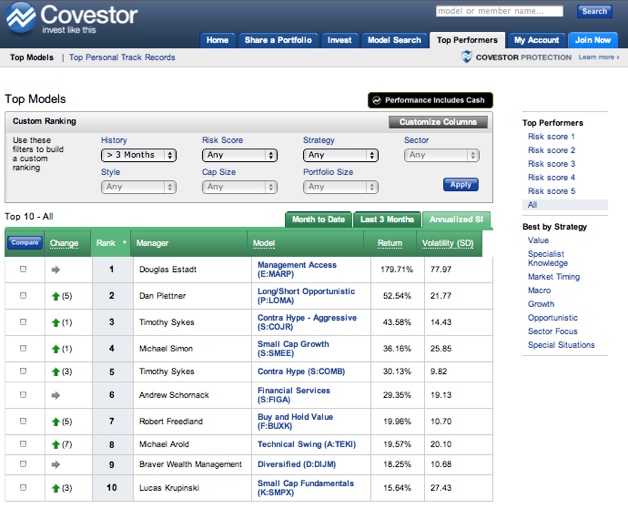

In fact, the entire site has been revamped. There is better search and more detailed investor profile pages. When you rank investment returns, you can toggle between the top tracked models which you can track with your own portfolio, and the top personal track records across the entire Covestor community.

By combining the two communities together, it will now be easier to market the tracked portfolio service and to promote the top Covestor investors into investment advisory roles. Currently, there are 70 portfolios which you can track with your own portfolio. The way this works is that you follow a portfolio, and every time that investor makes a trade, the information is relayed to your brokerage account where it is mimicked. Technically, the stock pickers aren’t managing your money. They are simply trading for their own account and selling you the trading data, which Covestor then helps you replicate in your account within two minutes of each trade. You really are following these investors in every sense of the word.

Competing social investing sites KaChing also lets you tie your brokerage account to the portfolios of the best stock pickers on its site. But unlike KaChing, all the data on Covestor is tied to real portfolios. CEO Perry Blacher thinks this makes a big difference. “There is nothing more credible than knowing this guy has skin in the game and he’s in it with me,” says Blacher. (Update: Apparently, KaChing now agrees. It also requires its professional investment managers to invest real money, which wasn’t the original plan). Ultimately, the site which attracts the best investors, and thus delivers the best returns, will win.

Covestor selects which investors can sell their data to users and pays a fee for each subscriber, which can range from $50 to $1000 a year—the investors set the price. Professional portfolio managers are also attracted to the service because it is a way to cut out some of the middlemen like Merrill Lynch and give them direct retail distribution. So a portfolio manager who usually requires a $250,000 or $1 million minimum investment, can set up an automated fund on Covestor to mirror their existing trades and reach smaller investors who only have $5,000 or $10,000 to invest.

“This is an open platform for people to compete and the best will rise to the top,” says CEO Perry Blacher. Covestor members build their reputations through their real-world investment savvy. They can even Tweet out each verified trade.

To qualify as an investment manager, however, there are three criteria. You must share your real trades, you must make available at least a year’s worth of audited trading history, and comply with Covestor’s trading rules such as staying away from illiquid stocks.

In order to follow along with a model portfolio, for now you have to open up an account with Covestor’s partner Interactive Brokers. But Blacher says more broker partnerships are on the way. “The brokers love this,” he says, “because we are busy generating trades for them.” With Interactive Brokers, each trade is only $1, which makes following an active trader more palatable for an individual investor paying for each trade.