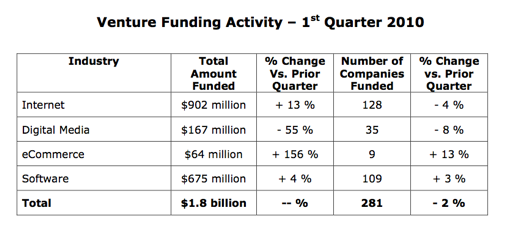

According to data compiled by VC database VentureDeal, total Q1 venture funding for 2010 stagnated from the previous quarter, with 281 companies raising $1.8 billion in venture capital funding, a decrease of 2% from Q4 2009. The company reported findings on four sectors of technology, Internet, Digital Media, eCommerce, and Software.

According to data compiled by VC database VentureDeal, total Q1 venture funding for 2010 stagnated from the previous quarter, with 281 companies raising $1.8 billion in venture capital funding, a decrease of 2% from Q4 2009. The company reported findings on four sectors of technology, Internet, Digital Media, eCommerce, and Software.

Funding to startups in the Digital Media space decreased by 55% to $167 million, with 35 companies being funded, a decrease of 8% versus the previous quarter. E-Commerce on the other hand, saw the biggest jump in funding. For the quarter, 9 commerce companies received a total of $64 million in funding, a whopping increase of 156% in financing amounts versus the previous quarter thanks to massive rounds such as the investment in Boku in January, which totaled $25 million.

Software startup investments ended up as the second largest sector in terms of total amounts, raising $675 million between 109 companies, an increase of 4% in total funding amount and an increase of 3% in the number of companies funded. The largest funding of the quarter was a $110 million round for PowerPlan, which sells fixed asset software.

Internet sectorinvestments continued their previous quarterly increase by rising 13% in terms of total funding. The sector received $902 million in venture capital funding during the quarter allocated among 128 companies, which represents a decrease of 4% in the number of companies funded. Big rounds for the quarter included a $100 million investment in Yelp and $75 million in uStream.

An April report from CrunchBase data also indicated the venture funding had dropped from the fourth quarter of 2009. But it’s interesting to see the e-commerce sector picking up speed in terms of investments. Surely the latest Gilt and Groupon funding rounds indicate that the trend is continuing through 2010.