While it’s easy to rag on Blippy for their controversial model (making credit card transactions social), and their security slip-ups (making credit card numbers social), it’s hard to deny that there is something compelling behind the idea. If there weren’t, no one would use the service. Enter Swipely, a service that also aims to make your purchases more social. But rather than focus on the money, they focus on the transactions themselves.

While it’s easy to rag on Blippy for their controversial model (making credit card transactions social), and their security slip-ups (making credit card numbers social), it’s hard to deny that there is something compelling behind the idea. If there weren’t, no one would use the service. Enter Swipely, a service that also aims to make your purchases more social. But rather than focus on the money, they focus on the transactions themselves.

When Microsoft bought TellMe in 2007, co-founder Angus Davis was probably set for life. After all, that deal was rumored to be in the $800 million to $1 billion range. But Davis left Microsoft in May of last year because he was getting the entrepreneurial itch again. By the Summer, he had his plan to create Swipely. And by the Fall, he had many of his former TellMe colleagues with him, and about a million dollars in angel funding. Now his project is ready to be unveiled, and they’ve taken a new $7.5 million Series A round to make sure it succeeds.

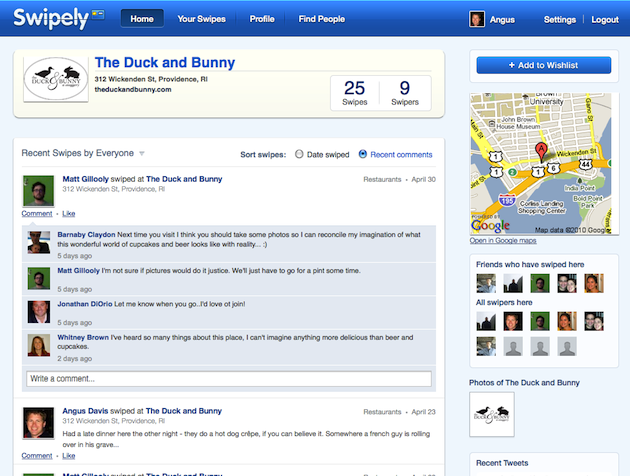

As I alluded to, Swipely is similar to Blippy in that the idea is to make your everyday transactions social. But the two differ greatly in their execution. The key idea behind Swipely is to “add value to every swipe,” Davis says. What he means by this is that with every swipe of a credit card, Swipely wants to make that information more useful to both you and your friends. It’s not about how much you’re spending (Swipely doesn’t show that), but rather, where you’re spending your money and what you’re buying.

And rather than automatically posting each of these transactions, by default, you choose what you want to post. You can choose if you want to post just purchases made at restaurants, for example. When you do so, the hope is that it sparks up a conversation about the transaction. For certain items, Swipely can easily populate what you bought thanks to a large database of menus and store catalogs. For other things, you can simply leave a comment below a transaction, just as you see below items on services like Facebook. And yes, your contacts will be able to “like” anything you buy.

Davis cites a Nelson report in saying that “the word American’s associate with advertising is ‘false’.” The remedy for that, he believes is Swipely. If a person you knows bought something or can vouch for a certain store, you’re more likely to go there, is the line of thinking. And it works the other way. If there’s something a friend of yours wants to warn you to avoid, a Swipely note can begin a discussion as to why.

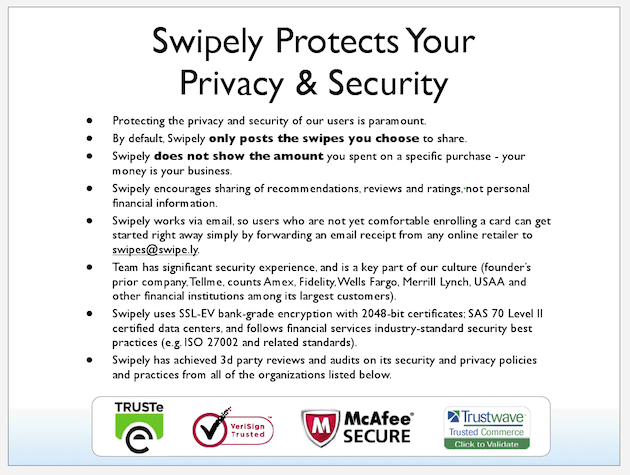

As I said, the core idea behind this just makes sense. And there are a number of potential business models that can pop-up from this (though Davis says the focus for now will be on growth and not a business model). And when you take out Blippy’s controversial money element, it may make sense to even more potential users. And, not surprisingly, Davis played up Swipely’s impressive security measures (see the slide below) to make it clear that they plan to have an episodes like the one Blippy had.

Swipely is launching today in limited beta, but they’ve given us 100 invites to give to readers. Simply use the code TECHCRUNCH, and if you’re among the first 100, you’ll get in.

The service’s $7.5 million Series A was led by Index Ventures. Greylock Partners and previous investor First Round Capital also participated. Danny Rimer of Index will join Swipely’s Board, and Reid Hoffman will join on as an observer. There were also a number of angels who participated in the round including Chris Sacca’s Lowercase Capital, Slide’s Keith Rabois, Ron Conway’s SV Angel, and Anton Commissaris, a former VP at Mint who is now a director at Intuit. There are other individual investors as well, including Davis himself.

Davis wouldn’t rule out the idea of Swipely ever showing the amount of money spent on transactions on Swipely, and even noted that it could be useful in some instances such as charity. But the key is the “story behind the purchase” not necessarily the purchase itself, he says.