It’s been one year exactly since Silicon Valley venture capitalists decided to call an end to the funding party. Sequoia Capital started things off with a 56 slide presentation to portfolio CEOs titled R.I.P. Good Times. In it they warned “it’s different this time” and said that “survival of the quickest” mandated deep cost cutting.

Benchmark Capital also communicated with their CEOs, telling them to “Be calm, but pragmatic” and “You don’t realize how fast things spin out of control.” Super angel Ron Conway likewise warned his companies, saying of the spreading financial crisis, “we will not be “immune” to its drastic effects.”

So it’s been a year of massive layoffs (we’ve tracked more than 340,000 since August 2008). When you’re cutting costs, people are usually the first to go.

But one thing we didn’t see over the last year is a complete drying up of new funding, or large scale deadpooling of startups. Either the advice was off target in the first place, or the buckling down and cost cuts worked.

It’s probably a little of both.

Earlier today I spoke with Ron Conway and asked him what he thought of the last year and how things worked out. He said “We’ve seen an explosion of real time data startups which has helped offset the downturn in Silicon Valley. We still see 5-6 deals a day, which tells me the market is very vibrant. I feel like we’ve weathered the storm very nicely. Also, a lot of companies that needed money last year raised money quickly or cut costs and survived, so we had a lower failure rate than we thought we would.”

I also spoke with Pete Flint from Sequoia and Conway backed Trulia today (so he was hit from two investors a year ago). Trulia, a real estate startup, had 80 employees a year ago. They did not lay anyone off, says Flint, and have 90 employees today. They are now approaching breakeven as well, he says. Revenue has grown significantly over the last 12 months, he says. And while he won’t disclose revenue, 90 employees suggests payroll in the range of $1 million per month alone. The real estate market has gotten tougher in the last 12 months, and Trulia makes money from real estate professionals and companies via subscriptions and advertising. But they’ve found a way to struggle through and are at the threshold of profitability. One strategic choice the company made a year ago, says Flint, was to diversify revenue away from few big advertisers to lots of smaller ones. Trulia has raised $33 million to date, and the last time they raised money was Q2 2008.

Certainly there have been some hard times. We tracked a steep decline in venture investments and liquidity events earlier this year, particularly when tracked against the peaks of Q4 2007.

But Silicon Valley certainly seems stable right now, particularly when you compare 2009 to 2008. We track venture funding and acquisitions on CrunchBase, and we are just now preparing to publish Q3 data for download (it should be up later this week or next). I’ve taken a look at the data, and it’s surprising.

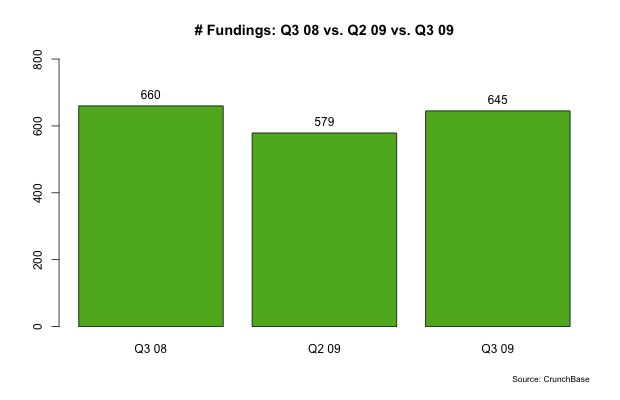

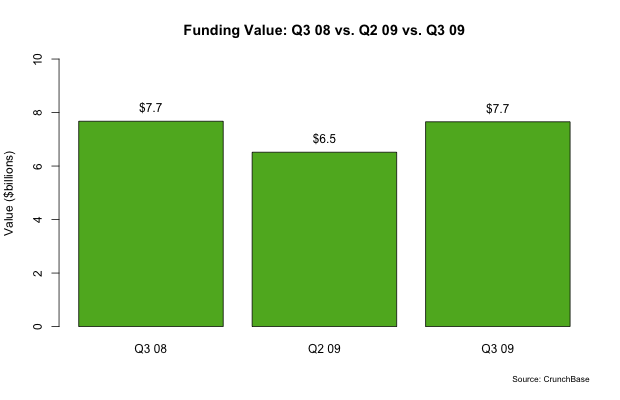

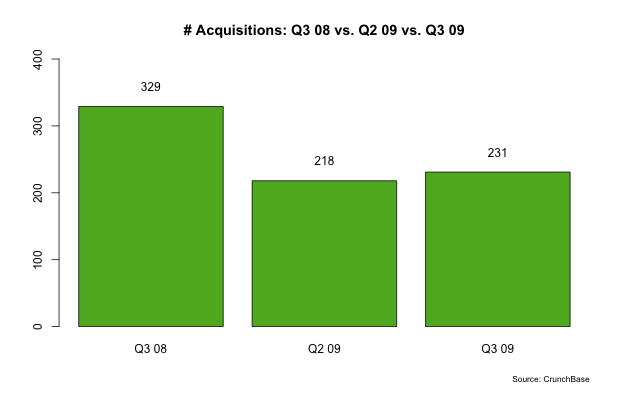

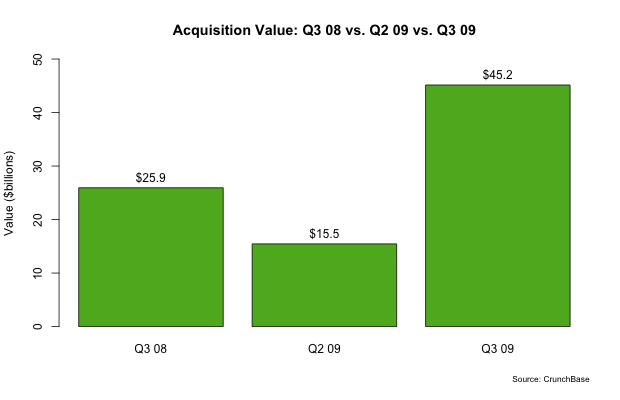

There were 645 venture financings for a total of $7.7 billion in Q3 2009, v. 660 and $7.7 billion in Q3 2008 (basically flat, but not down at all). Acquisitions have become less common, but the average price is way up. There were 231 acquisitions in Q3 2009 for an aggregate of $45.2 billion. In Q3 2008, there were 329 acquisitions for $25.9 billion in aggregate.

Charts are below for all of these, and we’ll have a deeper dive on the data shortly. But for now at least, the sky has yet to fall.