We all like the idea of setting aside a nice chunk of money in a savings account and putting it to work for us, but it’s a bit easier said than done — if you want the best rates, you have to choose from one of hundreds of CDs and savings account products offered by various banks, each of which has its own rates and restrictions. BillShrink, the startup that targets a variety of verticals to help users save money, is launching a new service today that looks to help make this decision much easier.

We all like the idea of setting aside a nice chunk of money in a savings account and putting it to work for us, but it’s a bit easier said than done — if you want the best rates, you have to choose from one of hundreds of CDs and savings account products offered by various banks, each of which has its own rates and restrictions. BillShrink, the startup that targets a variety of verticals to help users save money, is launching a new service today that looks to help make this decision much easier.

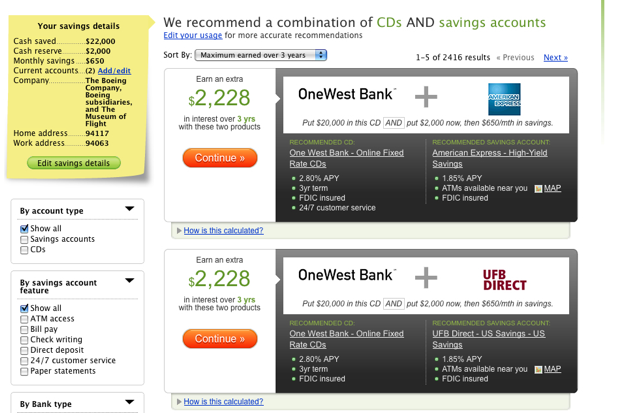

If you’ve used any of BillShrink’s other services before — which include cost cutters for cell phone plans, gas stations, and credit cards — you’ll be right at home here. To get started, BillShrink asks you where you’re currently keeping your money, as well as the amount that’s in your account. It doesn’t ask for your bank credentials (people tend to be far more hestitant to give these up than they are for their phone bills), but it does automatically look up details like your current APY which isn’t unique to the user. Hit submit, and BillShrink will present a list of its top matches, taking into account each product’s interest rates and any restrictions that might be involved.

And BillShrink goes far beyond just a basic listing. You can futher refine your results by specifying which features you want (for example, you might want to be able to withdraw money at ATMs, or get paper statements without an extra fee). You can also specify how long you’re willing to keep your money in an illiquid state, and if you enter your employer and region you can turn up special offers from smaller banks and credit unions.

As with BillShrink’s other services, the new savings feature has a clean, intuitive interface. That said there is still some room for improvement — I think the site could do a better job at holding the user’s hand through the process. While BillShrink does a good job offering contextual explanations (say, how it calculated the fees associated with a given product), it doesn’t attempt to educate the user, so there’s a chance some users won’t know what some of the terms mean.

BillShrink isn’t the first player here — BankRate.com has been a leader for quite a while, and Mint also offers a savings component that looks at savings accounts and CDs. But co-founder Samir Kothari says that BillShrink differs in a few key respects. For one, the site doesn’t offer any sponsored listings (both Mint and BankRate always show their sponsored products at the very top of the list, so you may not immediately notice the products that would give you the best returns). He also says that BillShrink’s customization options are more precise than what you’ll find on the other sites.

BillShrink has been having a very strong year, with 1000% growth since the beginning of the year (they’re now up to over 650,000 monthly visitors) and some major marketing love from T-Mobile).