Many people still think of IBM as the company that sells Big Iron—mainframes and its enterprise server descendants. Of course, the engine of the company’s profits long ago shifted to consulting and software. In a financial slide presentation IBM released today to the SEC as an 8K document, however, you really get a sense of how much IBM has continued to shift its business towards software and services over the past eight years.

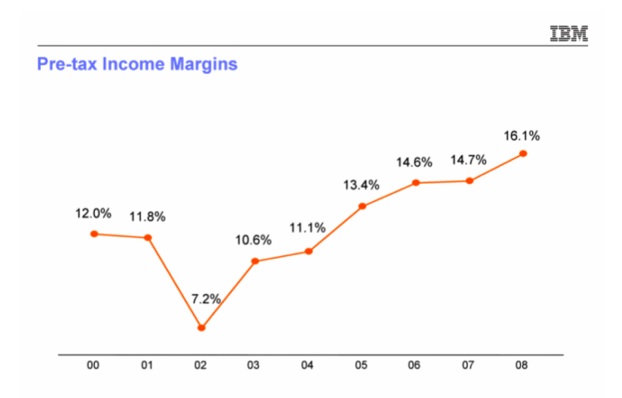

The result has been a very healthy expansion in its profit margins. As can be seen in the chart above, IBM’s pre-tax income margins have more than doubled from a low of 7.2 percent in 2002 to 16.1 percent in 2008. And the slide presentation suggests that IBM has further to go. It cites data showing that the top quartile of companies in the S&P 500, and 30 percent of tech companies, have pre-tax income margins of above 20 percent. IBM makes $90 billion in revenues per year, so each percentage gain in pre-tax profit margins adds up to nearly $1 billion.

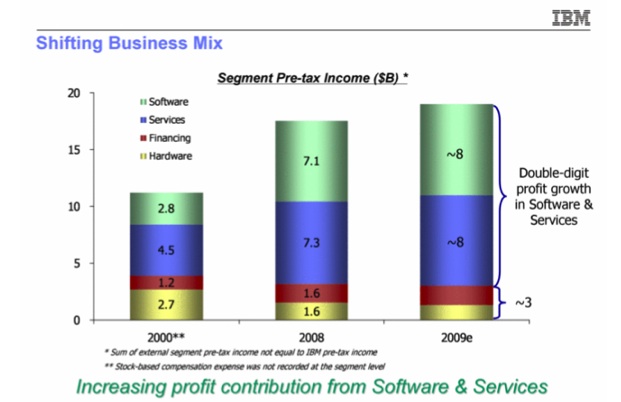

The reason for IBM’s margin expansion is that the pre-tax profits in its software and services businesses are growing at double-digit rates. Both segments will make an estimated $8 billion in pre-tax profits this year, compared to about $1.5 billion for hardware. Eight years ago, the software business brought in only $2.8 billion in pre-tax profits and the services business produced $4.5 billion.

IBM has made big investments in middleware, database software, virtualization, cloud computing, and business analytics, to name a few areas. It sounds like these are paying off big-time.

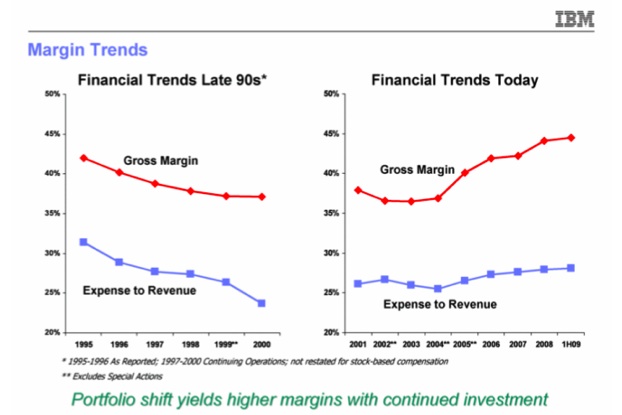

Contrast IBM’s financial condition today to that of the late 1990s. Back then, gross margins were declining every year, even as it was cutting expenses to compensate. Today, expenses as a percentage of revenues are actually going up as it continues to plow more money back into the business in the form of investments and R&D. Over the past five years, IBM spent $30 billion on R&D, second only to Microsoft’s $36 billion (Google spent only $7 billion, which also is less than Cisco, HP, and Oracle).