As readers know, I’m working on a new book about global entrepreneurship that is taking me around the world at the pace of roughly one country per month for the next year and a half. The plan is to focus on several contrasting hot spots for entrepreneurship and revisit them throughout the next year or so to see how the entrepreneurs and economies evolve over that time.

As readers know, I’m working on a new book about global entrepreneurship that is taking me around the world at the pace of roughly one country per month for the next year and a half. The plan is to focus on several contrasting hot spots for entrepreneurship and revisit them throughout the next year or so to see how the entrepreneurs and economies evolve over that time.

But since it’s early in the process, I’m still hitting many places for the first time, and it’s a challenge. I’m continually throwing myself into a culture and trying to absorb as much as I can from being on the ground, meeting with hundreds of entrepreneurs, and trying to ferret out some TechCrunch-worthy and book-worthy stories. Two-to-three weeks can go past in the blink of an eye, and frequently I leave with more questions than answers. More maddening: That’s usually a sign I’ve done my job. No place should be decipherable in two weeks. Especially not China.

China has just exploded with entrepreneurship, funding and economic opportunity over the last five years or so, and unlike most of the world there doesn’t seem to be a slow down yet. In 2002, U.S. investors pumped $437 million into China. By 2007 that had grown to $2.8 billion. And last year, it swelled again to $4.2 billion. All numbers courtesy of Dow Jones/VentureSource which should be releasing its first quarter China figures this week. Imagine Silicon Valley in 1999 times a huge sprawling country and population, and that’s what I’m wading into for the next two weeks.

On one hand, it’s exhilarating. In the US, we’ve all heard so much about the amazing Chinese economic engine, looking on with a mix of terror, greed and awe. It’s stunning actually to be on the ground here. But sifting through hundreds- even thousands- of Mandarin-speaking entrepreneurs is also a bit like trying to do an estate sale for Howard Hughes. There are priceless old films, keepsakes from starlets and antique aviator equipment, but also stacks of milk bottles, newspapers and nail clippings—where do you start?

This mild panic I’m finding myself in has me thinking a great deal about two characteristics of China that people have been referencing in the last few weeks as I’ve been planning this trip and doing pre-interviews: Patience and speed. They’re seemingly contradictory, and perhaps part of that is the collision of tradition and modernity in China right now.

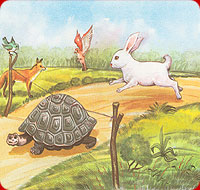

It’s important to realize that patience isn’t the same thing as being slow. It’s a mindset thing, not a factor of how fast you are moving. The Chinese people have always known they’d be one of the world’s major superpowers, known it with such conviction; they just had to let it unfold. And unfold it has. Even Internet entrepreneurs share this view, as Jack Ma of Alibaba said in this 2000 Forbes interview, “One must run as fast as a rabbit, but be as patient as a turtle.” Interestingly, Ma picks the good attributes of each animal: The speed of the rabbit but not the impatience and cockiness. And the patience of the tortoise but not the slow speed. (One could argue those are traits of large, fat and happy American multi-nationals that both Chinese and Silicon Valley startups seek to out-do.) Ma has also said that employees and customers come first, shareholders second. Why? They’re incapable of holding a long term view and he refuses to run his business quarter-to-quarter. For Ma, ten years is a short time. For U.S. investors—even VCs—ten years is a long-term investment horizon.

What many U.S. investors find baffling is how that patient mindset co-exists in a world that moves so quickly. Last night I had dinner with several ex-patriot entrepreneurs who said it’d be hard to leave Shanghai now because the speed with which the city runs has become addictive. Every few weeks there are new buildings. The restaurants open and close so quickly, one of the ex-pats says he calls a restaurant before he leaves the house, not to make reservations but to make sure its still there. Another laughed at the idea that he used to think Manhattan was fast-paced. He goes back to visit now, and it all seems the same.

I’m not even 24-hours into my adventure in China, but I’m interested to learn more about how these two traits manifest themselves in the startup world here. Already, I’m hearing about a distaste for raising U.S. money because of an insistence on predictable and unnatural growth metrics. My guess is the successful investors will be the ones that yield to the Chinese way of thinking on this, not the reverse. Indeed, a short-term nature of investing is a big part of why our capital markets are broken, and over the last few decades as Wall Street funds and endowments have become the main backers of VCs, that short-term-thinking disease has spread into what used to be a risky but patient asset-class.