When tech startups get up and running one of things they need to work smoothly is cash flow. As the excellent presentation by William Reeve at GeeknRolla showed, cashflow can actually be an amazing weapon in your fight to create a business. But if the bank you are dealing with throttles your cashflow, how are you going to stay in business?

When tech startups get up and running one of things they need to work smoothly is cash flow. As the excellent presentation by William Reeve at GeeknRolla showed, cashflow can actually be an amazing weapon in your fight to create a business. But if the bank you are dealing with throttles your cashflow, how are you going to stay in business?

That’s at least the conclusion of BoxedIce, a new UK tech startup that’s developing a server monitoring application called Server Density.

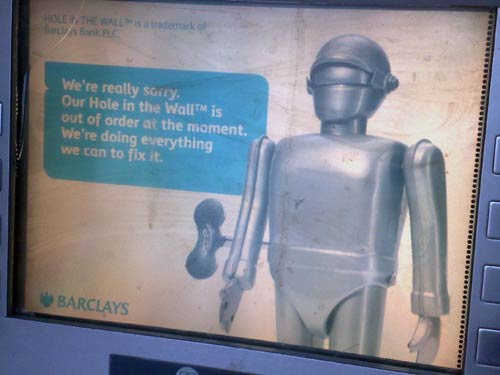

When founder David Mytton rang up Barclaycard Business recently to set up a merchant account he found that they had recently instituted a blanket 45 day deferred payment policy. In other words you’d have to wait almost 2 months for the money to clear, while still supplying the customer with your product or service at a loss.

Here’s some excerpts from his detailed blog post on the matter:

…I have a long history with the bank and its group companies. When I contacted Barclaycard Business to go through the process of setting up the merchant account for Boxed Ice, I was expecting them to provide the best rates (they have in the past) and since I had been through the process before, I knew what to expect and how long it was going to take. But this time round, it seems they have introduced a new policy: 45 day deferred settlement for all software / internet companies. A blanket policy. No exceptions. No appeals*.

This means that when a customer pays you, you won’t get the money for 45 days. Barclays keep it. If a customer pays you on the 1st Jan, you have to wait until 14th Feb, plus another 3 days for the actual transfer to complete. And they won’t be paying you interest either.

…If you have to wait almost 2 months for customer payments to become available then that is 2 months you have to survive and supply the customer with the product or service at a loss.

Looking at it from Barclays’ point of view, selling intangible goods like downloadable software and SaaS may well be seen as a higher risk because the customer does not ever receive anything physical and you can’t point to a Royal Mail delivery signature to prove the product was delivered. However, that is actually a false risk. In our case, we bill the customer after their first month of usage. This is the same for a lot of other tech companies, especially in the case of free trials and usage based billing. The customer has already received the service and been using it for weeks before they are billed.

This means the customer might actually be using your product for almost 3 months before you get any money – 30 day free trial + 45 day settlement + 3 day transfer time.

With a physical product, if the customer wins any chargeback then the company has to get the product returned (which might not even be worth the expense if it’s a low value product) and there are losses on packaging and shipping. There’s no such risk with a software sale because there is no unit cost (ignoring hosting costs), just overheads.

… Barclays will be missing out on a lot of good business if they continue this policy. Maybe they have decided they don’t want to service the tech industry. That’s their choice, but it seems like a bad one to me. From what I can see, Barclays hates tech startups and wants to keep their money for as long as possible.

* I was told on the phone I could appeal the decision by contacting my local business account manager but after speaking to his Barclaycard Business contact, he said there was nothing he could do, regardless of my past history.

In an economy where banks are supposed to be making amends for contributing to the global economic collapse, it’s dissappointing that Barclays thinks it can behave in this way.

Perhaps it is too busy with creating its tax haven in Ghana to aid the siphoning of West Africa’s vast mineral wealth away from its people.

Feel free to add your suggestions for banks geared towards startups in the comments below.