One thing we are finally going to learn in this down market is whether social investing can hold its own against the pros. There are many Websites devoted to social investing—Cake Financial, SocialPicks, StockMantra—each with their own twist. Add to the list Piqqem, a site run by Crowd Technologies that just recently came out of stealth. (Crowd Technologies is also the company behind StockMoose, which it launched as a quick experiment to test some of its technologies). The company raised about $1 million in June, 2007 from some serious angel investors, including Mike Markkula (the first investor in Apple), Mike McCue (founder of TellMe), Brad Handler, Stefan Roever and John Levinson.

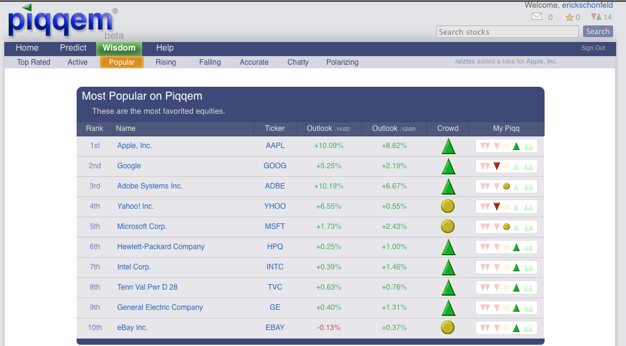

Piqqem collects votes from its users on where they think a stock’s price is headed. For any given stock on Piqqem, before you can see what the crowd thinks you have to give your own prediction. You can do this with a simple rating system (two arrows down, one arrow down, a neutral circle, one arrow up, or two arrows up) or by actually plotting a specific price in the future on a stock chart. Piqqem collects all of these predictions and tells you what its members are collectively thinking about each particular stock.

CEO Jett Winter explains:

In general, we differ from the other sites in that we are a true wisdom of crowds sourcing application. That is, everyone gets one vote and they can vote as much as they want. We then aggregate and report the results. We don’t try to find the best single stock picker (like virtually everyone else) as that really isn’t wisdom of crowds anymore. Further, there is no weighting based on your ability to invest.

Rather than take the advice of any particular pro, Piqqem pulls together everyone’s opinion and generates a collective opinion. You can see this on the site, which offers lists for the top rated stocks, the most active stocks, the ones where sentiment is rising, and the ones here it is falling.

If nothing else, Piqqem is certainly a good place to get ideas for stocks to invest in. But does it really have any chance of ever beating the market? Like any social investing site, its picks are only as good as the people who contribute to it. But beyond that, there is fatal flaw to this approach.

When it comes to stocks, the best prediction market out there is the stock market itself. It is the biggest prediction market out there, with millions of people predicting the future price of stocks every time they buy or sell shares. All of those predictions are aggregated together in the form of the price. To think that a few thousand, or even a few hundred thousand, people on Piqqem can do better is naive. And in fact, if you look at the prediction lines on Piqqem they already closely hue the actual stock price.

Winter counters that Piqqem willwork because it takes money out of the equation:

The votes today, in the market, are also weighted based on money. If you have a lot of money you can move the market and set the price. In our view, the crowd as a whole has more “information” than any one entity in the market and over time the information the crowd knows will become evident to the people with the money. As the people with the money figure out this information they will move the market in the future—but hopefully we’ve predicted it before they move it!

Sorry, I don’t buy that. The votes should be weighted by money. If someone is willing to put down a million dollars on the shares of Apple going up, that should count more than someone who just puts $100 down (or worse, is just clicking on a Website). Money not only makes the predictions of a market better, it also makes it harder to game the system because there is more to lose if you turn out to be wrong.

Secondly, even assuming Piqqem is perfect and it does produce better stock picks than any one individual could, investors will quickly discover and then it will become a reflection of the market. Piqqem does not exist in an information vacuum.

Nevertheless, it’s still a fun site. Here are some screen shots: