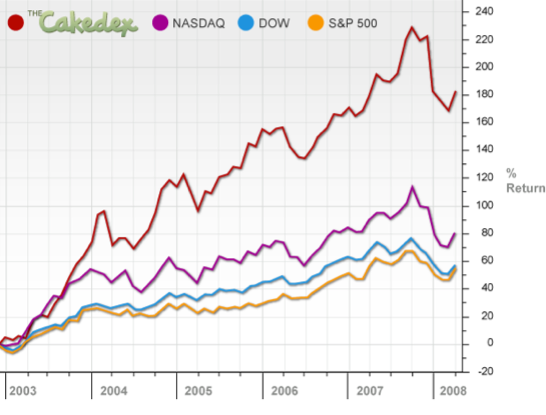

One year after it launched at TechCrunch40, Cake Financial is rolling out a new design today with a load of new features. One of the most interesting is a new stock index called the Cakedex that is based on the top 100 holdings of the top performing investors on the social investing site. Over the past five and half years, the Cakedex would have outperformed the S&P 500, the Dow Jones, and the Nasdaq. Although, over the past 90 days, it has been underperforming the major stock indexes. Next year, the company plans to launch an exchange-traded fund based on the Cakedex so that people can actually invest in it. Can the top investors on Cake do better than the market?

The Cakedex was actually introduced in May, but is now integrated into Cake’s new design timed with its first birthday. Cake members track the performance of their actual brokerage accounts and share that data with each other. Cake can now tap into 60 different brokerage services, up from a dozen or so. And has now tracked over one million transactions.

The Cakedex was actually introduced in May, but is now integrated into Cake’s new design timed with its first birthday. Cake members track the performance of their actual brokerage accounts and share that data with each other. Cake can now tap into 60 different brokerage services, up from a dozen or so. And has now tracked over one million transactions.

In addition to Cakedex, other new features include:

Cake Take: A stock rating system updated several times a day, based on the real-time buying and selling of stocks by Cake’s members. Cake has ratings for 2,033 stocks, mutual funds and ETfs (versus 3,069 for Schwab and 4,074 for Morningtsar).

Cake Scout: A stock recommendation system that uses collaborative filtering to show you what other Cake members with similar holdings and risk profiles are buying and selling. Each recommendation includes the Cake Take stock rating.

By adding these social recommendation features, Cake is becoming more like the Last.fm of investing. But it adds a ranking element so you know which members are worth following. Other social investing startups creating similar ranking systems include Covestor and Vestopia, and the race is on to create real financial products based on the social investing data that these startups are collecting.

Cake now has “tens of thousands of members,” according to CEO Steve Carpenter and is collectively tracking about $1 billion worth of assets. But the Cakedex is based only on the holdings of the top 10 percent of members. The biggest equities that make up the Cakedex are:

Apple

Visa

Google

Berkshire Hathaway

Oracle

Amazon

Washington Mutual

Intel

Research In Motion

General Electric

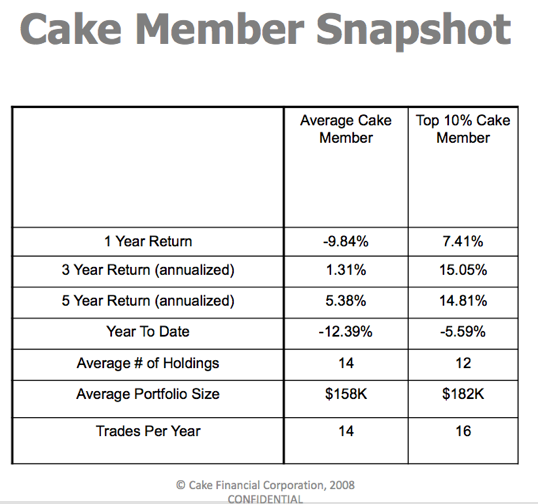

But how good are Cake’s top 10 percent beyond what is goes into the Cakedex? The average Cake member’s portfolio is down 9.84 percent over the past 12 months, while that of the average top-ten-percenter is up 7.41 percent. (YTD it is -12.39 percent versus -5.59 percent, respectively). So not bad. Maybe there is some wisdom in this crowd. Here are comparisons for other time periods: