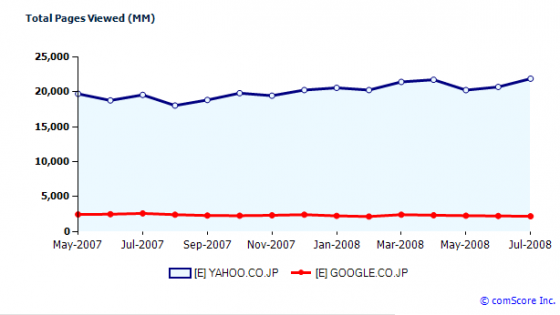

Google may be the leader in the worldwide search engine market, but in Nippon, it has some catching up to do: In 2007, Yahoo Japan saw a whopping 76% of the nearly 350 billion search engine and portal-related pageviews registered in the country, clearly outperforming Google (second with 5.4%, according to Nielsen Japan). More recently, ComScore shows that in July, Yahoo Japan had ten times as many monthly pageviews (21.9 billion versus 2.2 billion for Google) and nearly twice as many monthly unique Japanese visitors (46 million versus 26 million).

Google may be the leader in the worldwide search engine market, but in Nippon, it has some catching up to do: In 2007, Yahoo Japan saw a whopping 76% of the nearly 350 billion search engine and portal-related pageviews registered in the country, clearly outperforming Google (second with 5.4%, according to Nielsen Japan). More recently, ComScore shows that in July, Yahoo Japan had ten times as many monthly pageviews (21.9 billion versus 2.2 billion for Google) and nearly twice as many monthly unique Japanese visitors (46 million versus 26 million).

The Japanese web market is just too big to be shrugged off: The country boasts one of the highest Internet penetrations worldwide (74%, compared to 70% in the USA), a $5.7 billion online advertising market (out if one estimated to be worth $45 billion globally) and is ranked No. 3 in terms of total web population (94 million, about as many as Germany and the UK combined).

So how does Google challenge Yahoo’s position as the hub of the Japanese Internet?

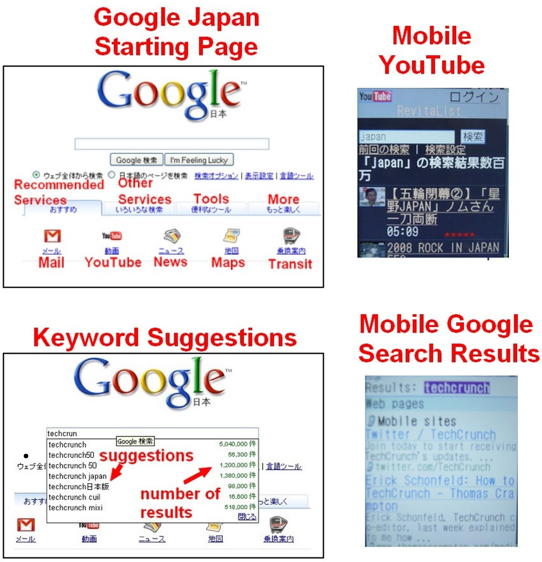

In the West, the popularity of Internet portals has waned in the past years, but not in Japan, where seven sites in Alexa Japan’s Top 25 are of this kind. That forced Google to change its simplistic design for the local market: Similar to Google China, for example, the Japanese version now contains tab links to other Google properties. It also features a keyword suggestion function in the searchbox.

In the West, the popularity of Internet portals has waned in the past years, but not in Japan, where seven sites in Alexa Japan’s Top 25 are of this kind. That forced Google to change its simplistic design for the local market: Similar to Google China, for example, the Japanese version now contains tab links to other Google properties. It also features a keyword suggestion function in the searchbox.

Nippon-only initiatives include allowing users of Mixi (Japan’s biggest social network) to embed Google Maps on their blogs, partnering up with web company Hatena (which operates Japan’s most popular social bookmarking service) and launching “One Green Project”, a microsite dedicated to prevent global warming.

But these measures are just of the cosmetic kind. In fact, Google Japan keeps localization of its fixed Internet site at a relatively low level (it doesn’t transform into a Yahoo-like portal site, for example). Instead, the company aims at taking over the Japanese market with a double-staged approach: Avoid Yahoo and take over the (bigger) mobile web market first to win the fixed Internet later.

Mash-up Strategy of Collaboration, Experimentation and Circumvention

Japanese cell phone carriers can regulate which search engine their Internet service subscribers use by default. A good spot on the official, pre-installed starting menus is crucial to winning the mass market.

That’s why in January this year, Google Japan inked a deal with the country’s leading telecom company NTT Docomo, following a partnership with the country’s No. 2 carrier KDDI au that started in 2006 (both mobile partners also were among the first to join the Open Handset Alliance but have been rather close-mouthed about Android development ever since).

Google’s mobile strategy—in Japan and possibly elsewhere—depends on whether the 74 million Docomo and KDDI au Internet subscribers will embrace the Googlization of their mobile web life. (Compare that number to the 15 million subscribers that the No. 3 carrier, Yahoo partner SoftBank, serves in this country)

Both NT Docomo and KDDi au incorporated Google’s search engine directly into their default start menus, synthesizing content from both mobile and PC web sites (including the display of contextual text ads). Users can also easily access Google Calendar, Youtube and other Google services. Some Docomo handsets now come with pre-installed Google Maps Mobile. In addition, Google gets access to a massive amount of behavioral data in the world’s most advanced mobile web market. So it’s no wonder Google Japan says its partnerships have had “a huge impact” on business and traffic (although it refuses to disclose specific details).

The company additionally uses insular, cell phone-enamored Japan as an isolated testbed for unique mobile web applications and services to be deployed worldwide at a later stage.

It’s not only about search and ads: KDDI au, for example, started to offer a rebranded, Japan-only version of mobile Gmail (“au one mail”). The service is free of charge and can also be accessed through PCs, doubling as a Trojan horse for Google to attack Yahoo Mail’s premier position in Nippon’s email arena. Japan is also the world’s first country where users can integrate animated picture characters into their mobile Gmails (very important in Nippon) and use Google Mobile to get extra-fast info after earthquakes strike.

The holistic strategy the company pursues not only avoids a losing, long-term confrontation with Yahoo Japan but also strengthens the brand among Japanese web users and the mobile industry in general. The company also gains insights on how to improve and adjust its search technology for the Japanese and international markets.

One examplary finding John Lagerling, head of Google’s Wireless Business in the region, publicly shares: Contrary to popular belief, traffic on mobile Google doesn’t get a big bump in the morning (when millions of Japanese commute to work and school) but peaks from 6pm through bed-time at 1am. Lagerling expects usage trends like this to be repeated outside of Japan once flat-rate data plans and browser-enabled handsets prevail on a global level.

Google’s multilayered strategy certainly makes sense strategically: Japanese people usually demonstrate unwavering loyalty in established, popular uber-brands like Yahoo. Google still needs to prove a) its now beneficial partnerships will sustain, b) it can really take over Yahoo’s place through the backdoor, c) what role Android will play in the future and d) how much Google’s Japan-specific experiences can shape the mobile web on a global level.