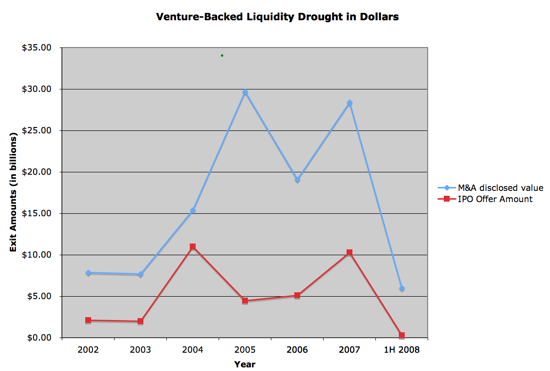

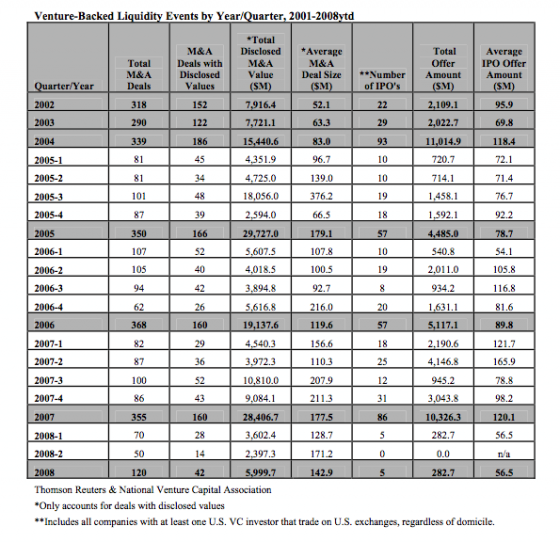

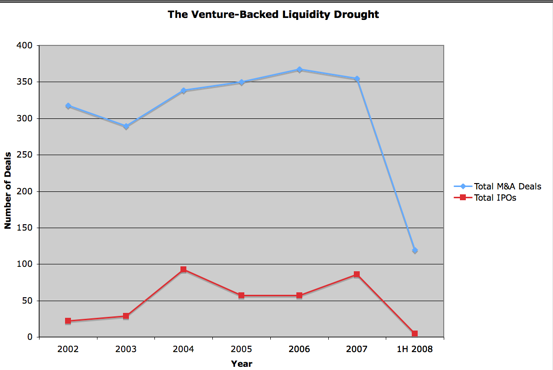

There were no venture-backed IPOs in the second quarter, and M&A deals are down. The last time there were no VC-backed IPOs in a quarter was in 1978. The liquidity drought for venture-backed startups is so bleak that the National Venture Capital Association is calling it a “crisis.” Last quarter there were only 5 IPOs that brought in a piddling $283 million. That compares to 43 IPOs during the first half of 2007 that brought in $6.3 billion.

(During the first half of 2008, 42 companies were in registration for an IPO, but they never pulled the trigger—versus 70 for the same period in 2007).

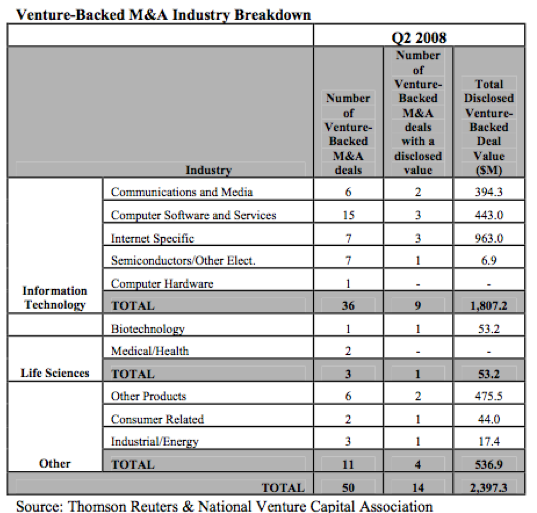

The other exit avenue for startups, getting acquired, is also getting narrower. During the first half of 2008, there were 120 VC-backed M&A deals, compared to 169 during the first half of 2007. Those deals whose amounts were disclosed brought in $6 billion, compared to $8.5 billion in 2007. That is 42 percent less cash for venture investors.

Before you cry yourself a river, consider that if VCs cannot get their money out of startups they may start to put less money into them. Much of this drought, however, seems to be tied to the weakness of the overall economy. It is a crisis that likely will pass. According to a survey of 660 venture capitalists conducted by the NVCA, the “three largest factors to which venture capitalists attribute the current IPO drought are:”

—Skittish investors: 77 percent

—Credit crunch/mortgage crisis: 64 percent

—Sarbanes Oxley regulation: 57 percent

Here are some of the other responses:

—Venture capitalists who do not see the IPO window opening in 2008: 81 percent

—Number of venture capitalists who believe that venture-backed companies are less

likely to want to go public today than they were 3 years ago: Two thirds—Venture capitalists who characterize the current IPO drought as “not critical” to the future health of the venture capital and entrepreneurial communities: 8 percent

Credit crunch aside, it might be time to amend Sarbanes Oxley at least for smaller companies. If the drought continues through 2008, startups that seek VC funding will start to feel the pinch, if they are not already. Yet one more reason to bootstrap your startup until you absolutely need that VC cash.