Today, Yahoo filed a presentation detailing its three-year financial plan that management gave to its board of directors in December, before Microsoft’s unsolicited bid. These rosy projections should be read in the context of that ongoing battle and Yahoo’s attempt to get a better price out of Microsoft. But this presentation also sheds some light on where exactly Yahoo sees its strengths. After going through it, vote what you think Yahoo’s board should do.

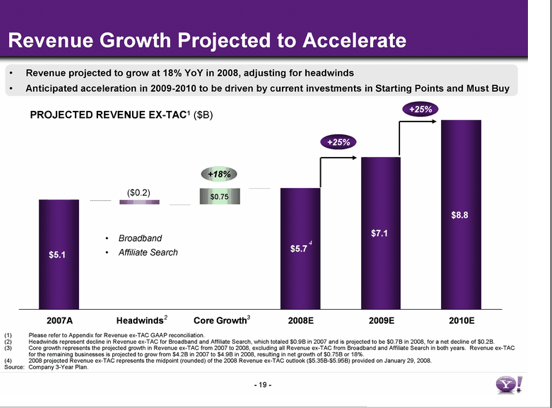

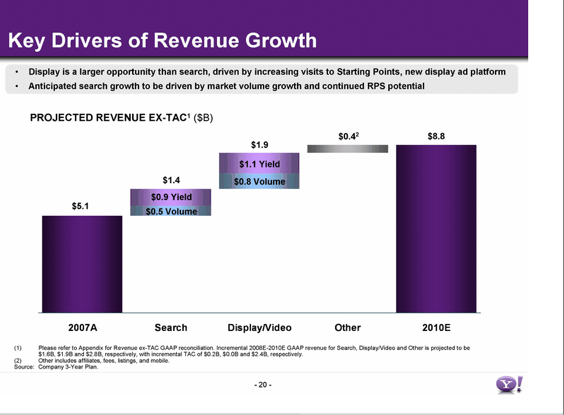

Yahoo is projecting revenues after traffic acquisition costs (TAC)—i.e., what it shares with other Websites that run Yahoo ads—to grow from $5.1 billion in 2007 to $8.8 billion in 2010.

How does it plan to grow revenues by 73 percent over that period? Here are some slides from the presentation (which you can find here at the SEC’s EDGAR Website, or just search for Yahoo).

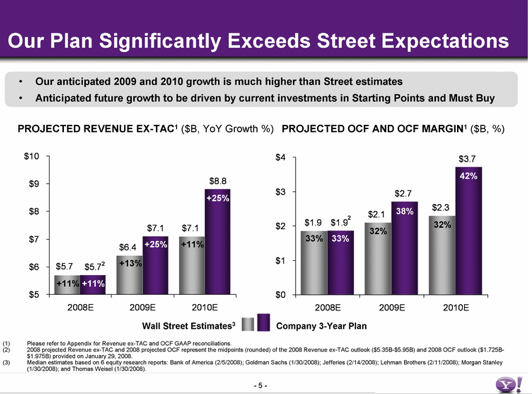

Yahoo argued to its board that it could exceed Wall Street expectations and accelerate revenue-growth to 25 percent in 2009 and 2010 and increase its operating cash flow from $1.9 billion this year to $3.7 billion in 2010:

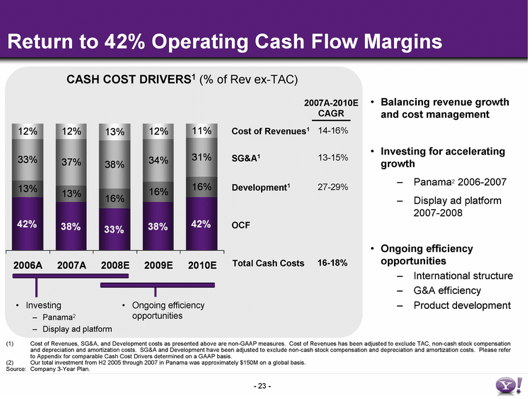

Notice that for these projections to come true, Yahoo needs to increase its operating cash flow margins to 42 percent from 33 percent. That seems overly optimistic, especially now that the economic outlook is so uncertain.

To justify its projections, Yahoo is counting on better clickthrough rates on its search, display and video ads.

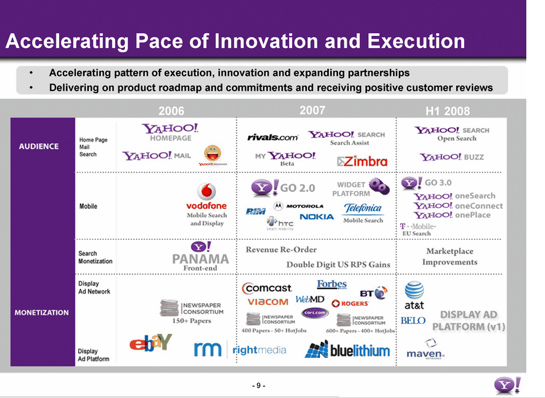

This next slide captures how that strategy has played out over the past couple years, with initiatives and deals categorized as either helping to build Yahoo’s audience or monetize that audience. (Notice the emphasis on Yahoo Buzz, Open Search, and Mobile—these are the things Yahoo is highlighting as growth drivers to its board. With mobile, in particular it feels like it does not get enough credit, and in another slide it notes that it has more than 600 million mobile subscribers have used its OneSearch product):

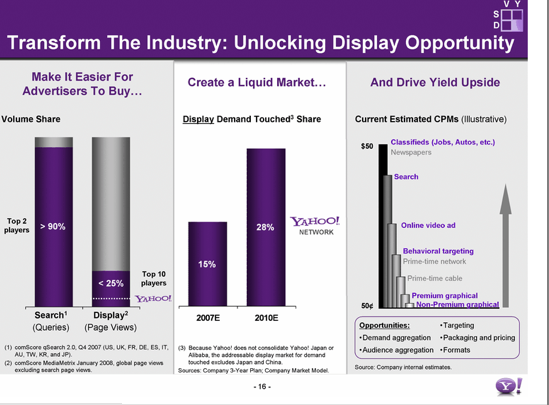

It sees its big opportunity in display advertising, where the top 10 players still control less than a quarter of the market and there is a lot of room for ad rates to go up:

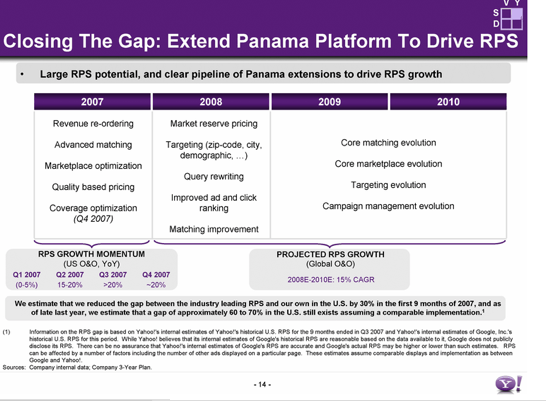

At the same time, it believes that it can continue to close the gap on its revenue-per-search, which it estimated to be 60 to 70 percent lower than Google’s at the end of 2007 (so it still has along way to go, see comScore data here on comparable clickthrough rates):

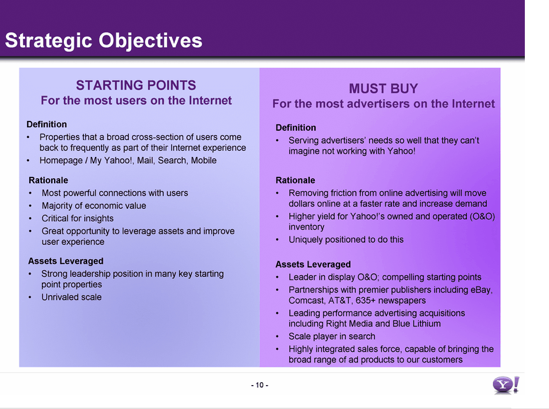

Yahoo’s overall strategy boils down to two things: attract an even bigger audience, and sell that audience to advertisers:

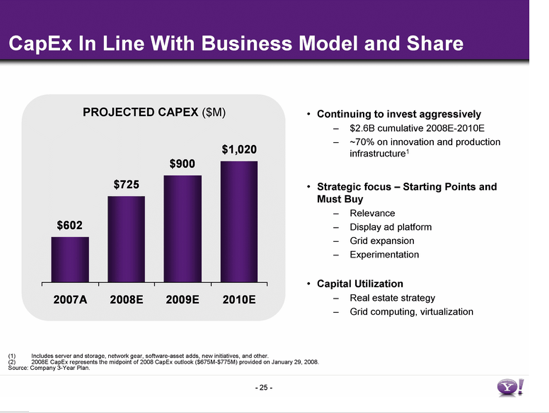

Finally, Yahoo is not timid about investing in the future. It wants to nearly double capital expenditures to $1 billion by 2010, with 70 percent of that going to “innovation and production infrastructure” (not that they have much of a choice there. Google’s CapEx in the fourth quarter—$678 million—was more than Yahoo’s for the entire year):

-

Sell Now, Before Microsoft Changes Its Mind

- Go It Alone. Yahoo’s Greatest Days Are Ahead of It.

Total Votes: 788

Started: March 18, 2008