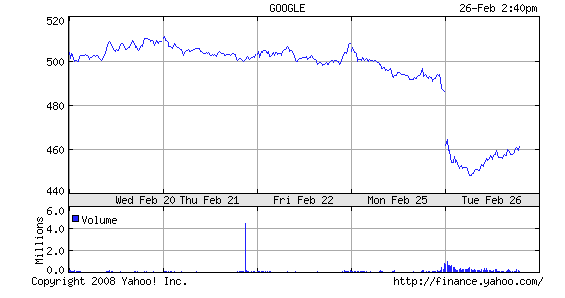

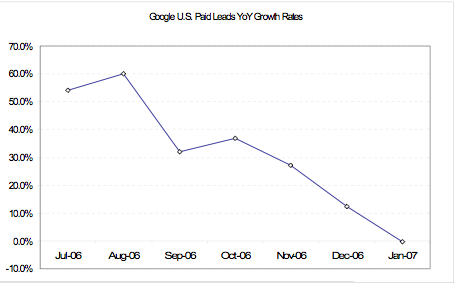

Google’s stock took a big hit today—still down 4 percent to $465—on comScore data suggesting that the click-through rate on its paid search ads is decelerating. As the chart above from Bear Stearns shows, the year-over-year growth of paid clicks on Google in the U.S. went from 37 percent in October to 0.3 percent in January. Since these are year-over-year numbers, seasonality is accounted for (there are more clicks in the months leading up to Christmas than after, but this January should not be flat with last January). The deceleration is alarming, to say the least. Even Henry Blodget, Mr. Google $2,000, now thinks this is a “disaster.”

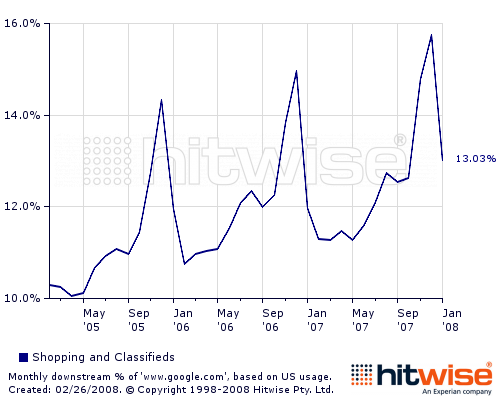

One explanation Wall Street analysts are putting out there today is that this could be an indicator that Google is not immune to the general economic slowdown. While a recession may be coming, that explanation is not convincing. Yahoo would have felt it as well, yet comScore reported a 15 percent year-over-year growth in paid clicks for Yahoo in January (to 242 million, compared to Google’s 532 million). Also, as Bill Tancer at Hitwise points out, traffic from Google to shopping sites is still above last year’s levels (evidence that paid clicks may actually be improving):

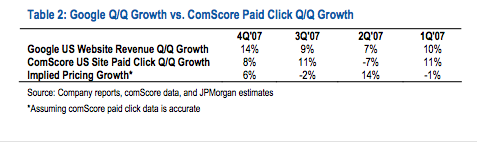

A more likely explanation is that Google is tightening the reins on clicks to combat click fraud and generate better clicks in general. Also the correlation between comScore’s click-through estimates and Google’s revenues has been highly inconsistent in the past. It definitely isn’t a one-to-one correlation. For instance, in the fourth quarter of 2007, comScore showed a 25 percent year-over-year paid click-through growth rate, yet Google’s actual U.S. revenues grew 46 percent. In the third quarter of last year, comScore showed a 48 percent growth rate for paid clicks, compared to an actual 58 percent growth in revenues. Sequential quarter-over-quarter comparisons are even more all over the map, according to calculations by JPMorgan.

So the comScore’s data maybe a leading indicator that all is not well at Google, it is not precise enough to calculate what the actual impact will be on Google’s business. What we are seeing here is the flip side of Google’s tight-lipped policy when it comes to giving investors any guidance whatsoever. Given this information vacuum, when the slightest bit of negative data comes out such as it did today, the market will assume the worst.

- $700

- $500

- $300

- $100

- $2,000

Total Votes: 1871

Started: February 26, 2008