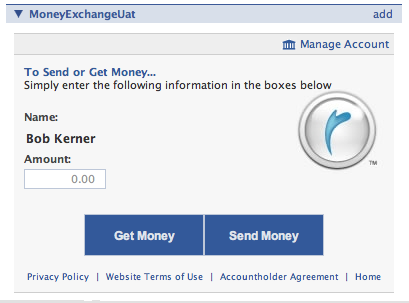

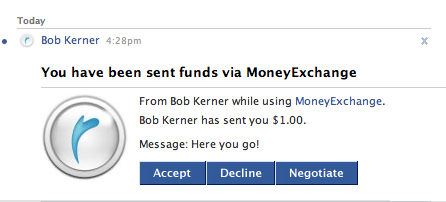

Steve Case wants to make some new friends on Facebook. Today, his startup Revolution Money launched a friend-to-friend payment application on Facebook called MoneyExchange (as of this writing, it is still waiting to be added to the Facebook Application directory, but click on the link above and it should take you there if you are a Facebook member). Just like PayPal, which already has an app on Facebook, MoneyExchange lets you send money to your friends or receive money from them. Of course, if they want the money, they have to sign up for the application, and link it to their bank account. But that’s exactly how PayPal went viral. Revolution Money is betting that putting a payment service inside a social network will multiply that viral effect.

Sending and receiving funds on Money Exchange is free (as it is on PayPal for funds between two PayPal members). Dave Cautin, the senior vice president in charge of Revolution Money’s online business explains, “It is an opportunity to very easily collect money from your friends and associates. It could be used by housemates sharing the rent, or friends chipping in to buy a group gift.” Of course, there are many other apps that do this on Facebook already, including ChipIn, CashFly, and PayFriends, which are all based on PayPal. OboPay, which lets you text money to your friends from a mobile phone, also has a Facebook app. None of these are particularly popular, however. PayPal has 65 active daily users on Facebook. ChipIn has 81. CashFly and OboPay each have 3.

Sending and receiving funds on Money Exchange is free (as it is on PayPal for funds between two PayPal members). Dave Cautin, the senior vice president in charge of Revolution Money’s online business explains, “It is an opportunity to very easily collect money from your friends and associates. It could be used by housemates sharing the rent, or friends chipping in to buy a group gift.” Of course, there are many other apps that do this on Facebook already, including ChipIn, CashFly, and PayFriends, which are all based on PayPal. OboPay, which lets you text money to your friends from a mobile phone, also has a Facebook app. None of these are particularly popular, however. PayPal has 65 active daily users on Facebook. ChipIn has 81. CashFly and OboPay each have 3.

Revolution Money sees an opening here. “Massive online communities will have a currency,” predicts Cautin. And he wants Revolution money to be it. “For us, social networking is our laser focus,” he says. The company is also working on integrating the payment service into AIM, and offers it through its own Website.

In truth, Revolution Money sees MoneyExchange as a loss leader for its real business, which is the RevolutionCard, its credit card that undercuts Visa and Mastercard. It has no intention of making money off of MoneyExchange by charging for transactions because in its eyes the online payment service is just a way to build up a valuable network of potential credit card customers. You can be sure that every MoneyExchange member will get an offer for the RevolutionCard. Steve Case is just seeding the market.