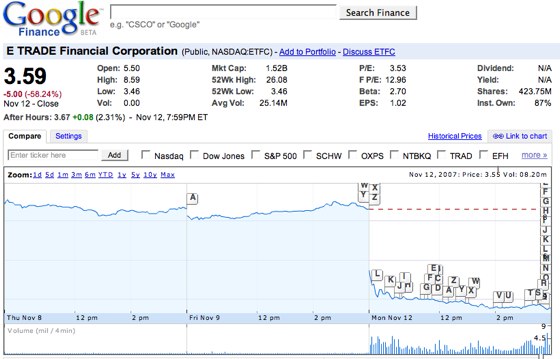

Shares in online broking firm E*Trade fell by over 50% Monday on speculation that the company may file for bankruptcy protection due to exposure to bad debt as part of the wider sub-prime mortgage crisis.

Shares in online broking firm E*Trade fell by over 50% Monday on speculation that the company may file for bankruptcy protection due to exposure to bad debt as part of the wider sub-prime mortgage crisis.

E*Trade is a granddaddy amongst online service providers, having been found in 1991 by TradePlus as a e-stock broking service for users of America Online and Compuserve. The company boomed during Web 1.0, and despite the downturn continued to thrive as more and more share owners moved away from traditional high priced broker services to low price online alternatives.

E*Trade’s quest to expand its business and sustain growth may end up being its downfall; the company built a “significant” mortgage business providing loans to its customers, but in doing so moved away from the fundamental product that had kept them well during previous downturns.

Citi Investment Research analyst Prashant Bhatia said that the loan writedowns and a Securities and Exchange Commission inquiry “could lead to a significant number of clients closing accounts,” suggesting a run on E*Trade accounts may be possible. E*Trade has a $3 billion loan exposure with a market cap of just $1.52 billion.