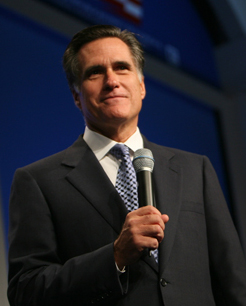

Last week I wrote asking for reader input into the questions we would ask Governor Mitt Romney, a Republican candidate for President in 2008, in an upcoming interview. Thanks to the great feedback in the comments, we were able to put together a list of questions to use for the Romney interview, as well as future podcasts with other candidates we are scheduling now.

Last week I wrote asking for reader input into the questions we would ask Governor Mitt Romney, a Republican candidate for President in 2008, in an upcoming interview. Thanks to the great feedback in the comments, we were able to put together a list of questions to use for the Romney interview, as well as future podcasts with other candidates we are scheduling now.

The interview is below. Due to time constraints with Governor Romney, however, we weren’t able to get through all of the questions. Instead of rushing, we divided the questions up into two parts; his campaign says they’ll try to schedule a follow up session. The campaign also requested that we push some specific questions for later so that he could give more thoughtful answers.

The areas we were able to cover include technology growth policies in the U.S., Internet taxes, H1B visas, venture capital tax issues (see Fred Wilson and the NYT on this issue) and renewable energy.

We were not able to cover net neutrality, the digital divide, mobile spectrum allocation issues, identity theft, China censorship or intellectual property issues on this call.

Overall, we got through a lot of material in a short amount of time. I also learned that Governor Romney is strictly a Windows guy, but he says three of his five sons are on Macs. And we get to hear what he’s listening to on his iPod these days (he does own an iPod, of course).

I want to thank Governor Romney for taking the time to do this interview, and going out on a limb somewhat. Most of the candidates are a little standoffish on bloggers – we’re seen as somewhat unpredictable at times (the political blogs are particularly nuts).

Listen to the podcast, or just read the transcript, below. For more on Governor Romney, see his official website, PoliticalBase and the Yahoo News page on Mitt Romney. As always, we are posting this interview at TalkCrunch as well.

Special Thanks to BitGravity, a new content delivery network specializing in rich media, for hosting the podcast for us. This is being linked to from Yahoo News and other sources, so we wanted to make sure that it streams quickly. Thankfully, BitGravity is making sure it just works.

Special Thanks to BitGravity, a new content delivery network specializing in rich media, for hosting the podcast for us. This is being linked to from Yahoo News and other sources, so we wanted to make sure that it streams quickly. Thankfully, BitGravity is making sure it just works.

Listen Now: http://www.talkcrunch.com/wp-content/plugins/podpress/player.swf

![]() Standard Podcast: Play Now | Play in Popup | Download

Standard Podcast: Play Now | Play in Popup | Download

document.getElementById(\’podPressPlayerSpace_192_label_mp3Player\’).innerHTML=\’Hide Player\’; document.getElementById(\’podPressPlayerSpace_192\’).alt = \’mp3Player\’;

Transcript

Michael Arrington: Hello, this is Mike Arrington from TechCrunch. Today I have the privilege of getting a few minutes to talk with Republican presidential candidate Mitt Romney about his positions on technology related issues. Governor Romney, thank you for taking the time to talk with me today and welcome.

Governor Mitt Romney: Thank you Michael. Good to be with you.

MA: So I noticed the new Iowa and New Hampshire polls were released yesterday and that you continue to have a very large lead among republican candidates. Congratulations on that.

MR: Well, thank you. I’m pleased that the places I spend most time in I’m doing better. If it were the other way around, where I spent the least time I was doing better, I would be in trouble.

MA: I have five or six questions for you and I’d like to just jump right in. I think the first one is fairly broad. The US technology industry, of course, has been a world leader. And a lot of the growth has been through international markets, particularly over the last ten to twenty years. What would you do as president to advance these efforts?

MR: Well, first it’s important to communicate as you do to your audience that the trade and opening markets to American goods is essential. The only way America is going to remain the world’s superpower is if we can compete globally, so I want to open more markets to our goods and I will negotiate with other nations to do so. At the same time I want to make sure that our trading with other nations is done on a fair basis, and when a nation like China does not honor our intellectual property rights then we’re going to have to get serious with our Chinese friends and say guys you just can’t do that or you’re going to suffer consequences in our markets. So we’re going to have to fight to make sure that our products are protected and our technology is protected but also to not close down foreign markets, open them up, we can compete around the world.

MA: Ok, great. Let’s jump into internet taxes, some news today on that actually. The 1998 Internet Tax Freedom Act bars federal state and local governments from taxing internet access or imposing discriminatory internet only taxes. Things like bit taxes, bandwidth taxes, email taxes. It doesn’t of course prohibit states from collecting sales taxes on things like e-commerce. It was twice extended by Congress and actually was set to expire this Thursday, but last week the Senate voted to extend the ban and then this morning the house voted 402-0 to approve the bill as well for a 7 year extension. I’d just like to get your position on internet only taxes.

MR: I think the indication of the house vote indicates that most American’s are of the point of view that Internet only taxes of the type you describe are not something we want to see. I have a specific position on that issue, but I do not want to see internet only taxes as you described them or access fees or email charges and so forth. We do enough taxing in this country and let’s not add more taxes. I’d rather see the tax for innovation reduced rather than expanded.

MA: It seems like along general party lines the Republicans wanted a permanent ban and Democrats wanted something less than that and they compromised on 7 years. Do you have any particular position on whether the ban should be permanent?

MR: Well I think it makes more sense to make it permanent. I think the Democrats recognized that if they do it every 7 years then they can go out and get contributions from companies that care and then vote for it every 7 years. It’s an old political ploy which is bring it back for a vote regularly and go back and hit people up for contributions…

MA: I didn’t think of it that way, that’s interesting. Let’s jump into visas, probably the most politically, one of the most sensitive issues in Silicon Valley at least. The H1B in particular, allows US employers to temporarily seek help from skilled foreigners, they have to have the equivalent of a US bachelor’s degree to qualify. We used to give, in the late 90s, 100-150k a year, there’s at least demand for 200k a year. In the last couple of years, the US quota for that has been brought down to 65k, and that was last year and this year. A lot of Silicon Valley startups and large companies in particular are saying it’s really hurting them with their hiring. Proponents of the program say it helps U.S. businesses stay competitive and it helps avoid outsourcing. It also brings some of the worlds best and brightest to the U.S. Quite a few of the most successful entrepreneurs in Silicon Valley started off as H1B visa holders. The other side says it can take jobs away from US citizens and lowers wages. What’s your position on H1B in general?

MR: I like H1B visas. I like the idea of the best and brightest in the world coming here. I’d rather have them come here permanently rather than come and go, but I believe our visa program is designed to help us solve gaps in our employment pool. Where there are individuals who have skills that we do not have in abundance here, I’d like to bring them here and contribute to our economy. Ultimately we’re in a competitive battle with the rest of the world; a battle where we need to stay the most powerful nation in the world. And the only way our nation stays ahead forever is with superior technology and innovation. And if we need additional folks who have skills that can contribute to our country then by all means lets welcome them in and if we see that our kids are not competing in certain areas lets help our kinds understand what they need to become competitive.

MA: Do you think the quota should be increased? Do you think their should be no quota? Should we let in everyone that is qualified?

MR: I would like to see us increase the number of people who receive an H1B visa and can provide skills and experience that we may not have. As to the exact number in my view that would follow a review of a number of things. Number 1: What’s the overall economy doing? What’s happening to the size of our workforce. Number 2: What’s happening to our own capacity in the jobs that are being requested. Number 3: What are the demands from our employers? How many additional folks do they need? You’d have to do an assessment of that on a regular basis, but my overall view is we need more H1B visas, not less.

MA: There’s an issue we talk about quite a bit in Silicon Valley about how venture capital is taxed. Venture capital is clearly the lifeblood of Silicon Valley that allows startups to form and grow without worrying about initial capital needs. Without that capital most public technology companies in the U.S. today would probably not exist or be in a much different form. one of the benefits of venture capital is the way they get their gains on their funds is they only pay capital gains on that carries interest even though they’re not investing their own money they’re only investing their limited partners money. It’s clearly a big incentive to be a successful venture capitalist because they’re taxed the capital gains rate. The capital gains rate is far below normal income tax rate. Congress in late spring looked at the issue to see if change is needed. Some prominent Venture Capitalists, Fred Wilson being one of them, came out and said they’re being taxed too low today and they should be paying normal income tax rates on what is effectively income. I have two questions for you, first what is your position on capital gains rate in general?

MR: I don’t believe that we should increase our capital gains tax rate. My view is in fact that for people earning 200k or less, we should eliminate the cap gains tax, the dividends tax, and the tax on interest altogether. I’d like Americans to save their money, and not get taxed on their savings. And with regard to carried interest associated with venture capital, real estate, private equity, I do not believe in raising taxes. And it is a capital gain because those individuals do make an investment, it’s a small investment, but they make an investment of their own capital and I would treat capital gains as capital gains instead of trying to re-categorize them as normal income.

MA: One more question and then I actually have a fun question. On renewable energy, strictly speaking we’re talking about science now and not just the internet and the areas I cover, it is a big area, an important area. My question is, what would you do to encourage U.S. innovation into renewable and sustainable energy sources?

MR: Well, first of all, as I mentioned a moment ago, the way a nation like ours stays ahead permanently from other nations is having superior technology and innovation and one of those areas that is certainly going to be true in relates to energy and I would like to see the federal government substantially increase its investment in basic science and basic research related to energy efficiency, energy production, energy distribution, and I will substantially increase funding in those areas . I will also work on public product partnerships to put in place coal to liquid capacity, potentially even nuclear power plants, and if you will, prime the pump again to get nuclear power plants online and under construction again in this country. I believe that we’re going to have to become to partner to encourage the development of these additional sources of energy, at the same time I want to create incentives for individuals and businesses to become more energy efficient. When I was governor for instance I said anybody who buys a car that is a high mileage vehicle, whether it’s a hybrid or not, I would waive the sales tax and the annual excise tax. Let’s give people more incentives to get fuel efficient vehicles.

MA: Here’s a more politically sensitive question. Based on current science which I know is still forming, do you think carbon emissions should be taxed?

MR: I’m not looking at a carbon emissions tax. No, instead I’m not looking at increasing taxes, but instead findings ways to develop new technology and encourage efficiency, but that’s not the course which I’ve laid out at this point.

MA: I guess that brings us to the most important question I have to ask you, which is…Governor Romney, Mac or PC?

MR: I have a PC. My sons have a Mac and swear by it, but I have a couple PC’s.

MA: So one of your sons is on Mac, or most of them are?

MR: 3 out of the 5 boys I believe are on Macs, and they swear by them, but I’m a creature of habit, I’ve got my PC.

MA: I’ve got to say I’m slightly disappointed and that’s going to hurt you in Silicon Valley (laughs), but at least it will help you in Texas where Dell is. Do you have an iPod?

MR: I do.

MA: Of course you have an IPod! What’s on it? What are you listening to right now, what sort of albums have you downloaded or listened to?

MR: What I typically download is country music as well as 1960’s music. I’m a baby boomer, so the Beatles and the Stones and some of the old groups from the 1960’s are my favorites, I listen to them and I listen to country. I might have some inspirational music as well, but those are the highlights for me.

MA: Governor Romney, thank you very much for your time.

MR: Good to be with you. Thanks Michael.